Pro AV Industry Ends 2020 on a Positive Note

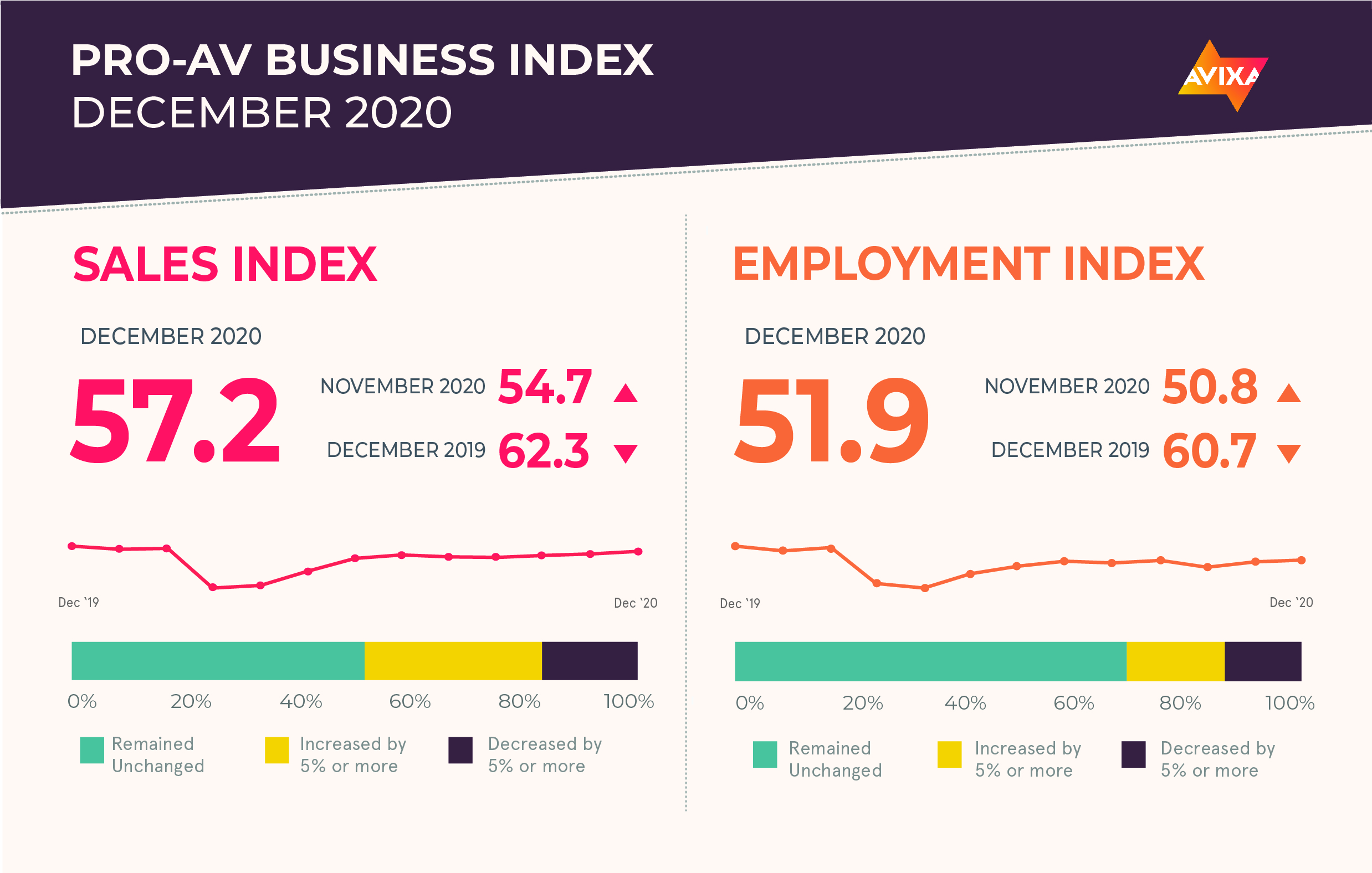

December’s AV sales index (AVI-S) measured 57.2, 2.5 points above the November reading of 54.7—which itself was 1.5 points above the October reading.

Over the past summer, the AVIXA market intelligence team went on record predicting accelerating growth to close out 2020. Soon after their prediction, August and September’s Pro AV Business Index numbers came in disappointingly low, showing only the smallest trickle of growth. But since that time, growth has rebounded, and we can now affirm the accuracy of our prediction.

December’s AV sales index (AVI-S) measured 57.2, 2.5 points above the November reading of 54.7—which itself was 1.5 points above the October reading. This is a new post-pandemic high and represents a pace of growth that would have been roughly in the normal range for the pre-pandemic years.

Among the providers in our global AV insights community, 56.2 percent reported a significant drop in AV revenue for the entire year, 24.8 percent reported roughly no change, and 19 percent reported a significant increase. Translating that into a diffusion index like we use for the AVI-S, we get a reading of 31.4. For comparison, this mark would have been the third worst mark this year: better than March (21.3) and April (23.9), but worse than May (37.6). This low reading reflects how difficult 2020 has been for AV. The year was a major blow, and we need significant improvement to reach full recovery.

Globally, countries are struggling to roll out vaccines to their citizens. The recent proliferation of approved vaccines creates a clear path to a return to normal life, including the much-anticipated renaissance of live events. The difficulties in administering available doses are proving greater than anticipated so far. These hiccups in distribution risk postponing the return to normal and should be carefully monitored by decision-makers of businesses supplying in-person AV solutions.

The AV Employment Index (AVI-E) also strengthened for the second consecutive month. Employment change remains more limited than sales change, as the December AVI-E reading of 51.9 is only a small amount above the no-net-change mark of 50. This indication of growth looks more positive when compared to the broader U.S. employment numbers, which show that the economy actually lost jobs for the first time since recovery began back in May. The drop of 140,000 is small, but any decline is a serious issue given that we are more than 10 million jobs below where we would be without the pandemic.

“Going forward, observers should expect the AVI-E to lag behind the AVI-S,” said Peter Hansen, economic analyst, AVIXA. “Expanding payroll is both a risk and a challenge for businesses, making them more hesitant to do so. As a result, we’ll need to see continued strong sales growth before hiring starts to pick up. In terms of recovery, revenue will get back to pre-pandemic highs well before employment does.”

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

Follow Business Trends with AVIXA

- Pro AV Industry Ends 2020 on a Positive Note (published in Feb 2021 SCN)

- November Sees Accelerating Growth for Pro AV Industry (Jan 2021 SCN)

- October Shows More Signs of Recovery for Pro AV (Dec 2020 SCN)

- An Ounce of Growth for Pro AV (Nov 2020 SCN)

- Pro AV Recovery Makes Feeble First Steps (Oct 2020 SCN)

- This Is Refreshing: Good News for Pro AV (Sep 2020 SCN)

- Pro AV Industry Achieves Neutral Growth Conditions (Aug 2020 SCN)

- Trends Start to Bend Upward (July 2020 SCN)

- Pro AV Suffers Under Weight of COVID-19 Crisis (June 2020 SCN)

- Pro AV Feels COVID-19 Impact (May 2020 SCN)

- Coronavirus Shoe Yet to Drop for Pro AV (Apr 2020 SCN)

- Pro AV Sales Growth Slows at the Start of 2020 (Mar 2020 SCN)

- Pro AV Grows as New Decade Dawns and Brexit Looms (Feb 2020 SCN)

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.