November Sees Accelerating Growth for Pro AV Industry

AVIXA’s latest Pro AV Business Index has good news to report: November 2020 marked the best month of AV sales growth since the start of the pandemic.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

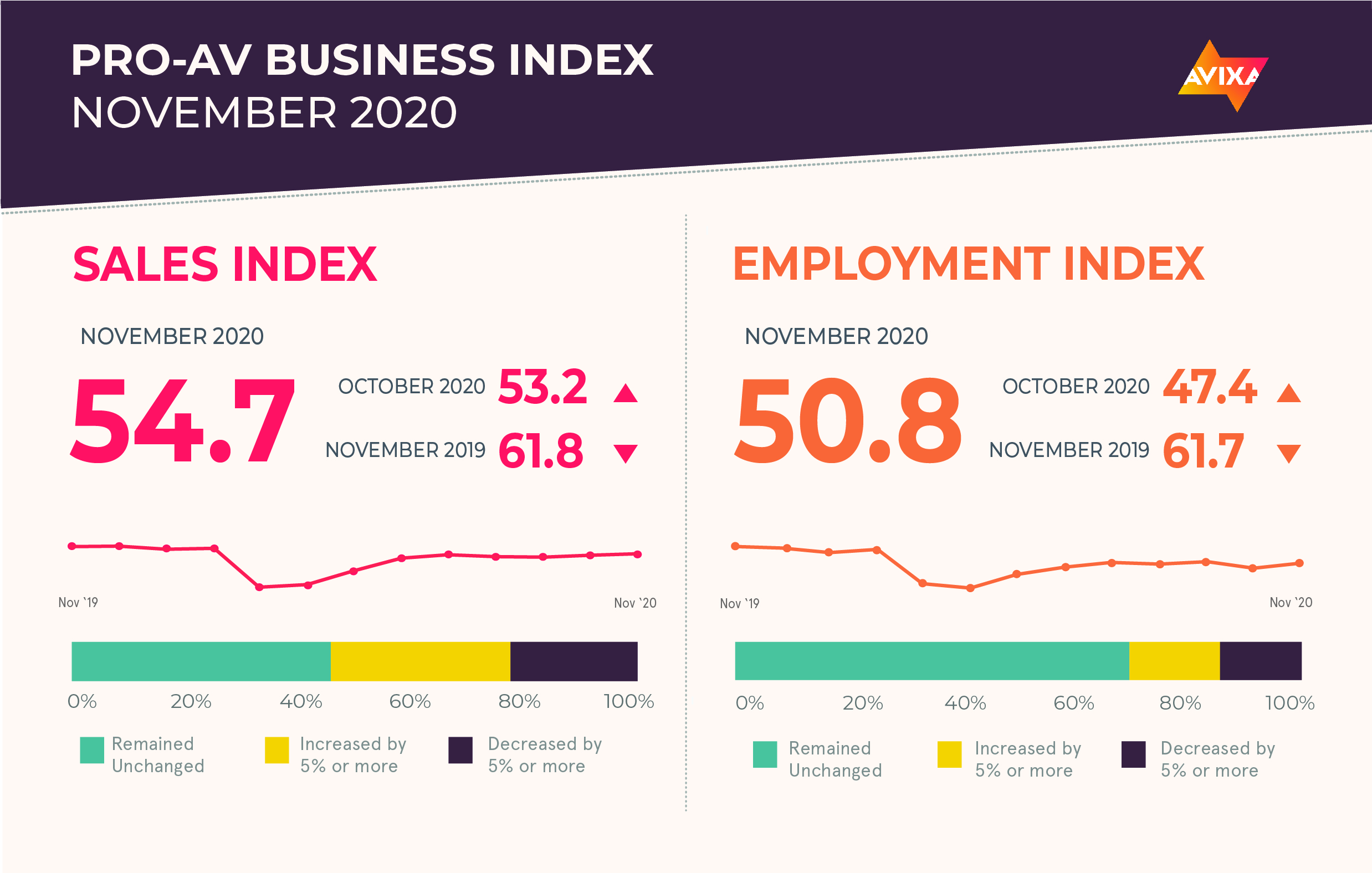

AVIXA’s latest Pro AV Business Index has good news to report: November marked the best month of AV sales growth since the start of the pandemic. The AV Sales Index (AVI-S) built on its momentum from October’s acceleration, increasing 1.5 points to reach a score of 54.7. This figure is lower than the index’s typical pre-pandemic levels, which hovered near 60, but this result shows the industry is headed in the right direction.

Flexibility was the key to success for many survey respondents. COVID-19 continues to flatten markets such as live events, but it is driving expenditures in many other areas. Respondents who have pivoted extensively seem to have managed to develop sufficient new revenue streams.

“This month’s figure is extremely heartening to see,” said Peter Hansen, economic analyst, AVIXA. “In late summer, the AVIXA market intelligence team predicted an acceleration of growth to close out the year. The severity and spread of the autumn COVID-19 wave threatened that forecast, but clearly, the flexibility of the AV community has created revenue streams that resist additional restrictions and behavior changes. This bodes well for a potentially tough winter while we wait for vaccines to proliferate.”

Equity markets—particularly in the United States—soared in November. Stock markets reaching record highs is part neutral news and part good news. On the neutral side, it does little for the pocketbook of the middle-class consumer, who drives AV spending in spaces such as hospitality, retail, and venues, and events. On the positive side, it gives companies the capital they need to make investments such as retrofitting an office to facilitate remote meetings or constructing heated and ventilated pods for COVID-safe dining.

One word of caution about the current market: Even now, almost a year into the pandemic and with stocks hitting new highs, uncertainty remains high. VIX, the leading uncertainty measure, remains above 20. For comparison, VIX did not surpass 20 in the 12 months leading up to the pandemic. Equity markets are not yet normal again.

The AV Employment Index also showed improvement in November as it ticked up 3.4 points to 50.8. This mark could be better—it essentially means AV payrolls were flat—but it’s good to see the bounce back after the weaker performance in October. The proper interpretation of current conditions is that payrolls are essentially stable. Growth would be preferable, but given the serious second waves of the coronavirus hitting Europe and the Americas, stability is probably the best we could hope for.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.