AVIXA Report: Winning Result in March as Clouds Darken

Tariffs (and their related uncertainty) were by far the top concern.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The overall economy has not been great, but it’s been OK in recent quarters, and the same could probably be said of the AV Sales Index (AVI-S), too. That’s actually an unusual combination; typically, our industry comfortably outperforms the wider economy.

[Viewpoint: Make Room for 'Digital Electricity']

Based on the economic signals we’ve gotten so far this year, we would expect the AVI-S to be probably in the upper 50s or even 60, but it’s languished in the low 50s. That is understandable given the transitions out of the pandemic, but it is disappointing.

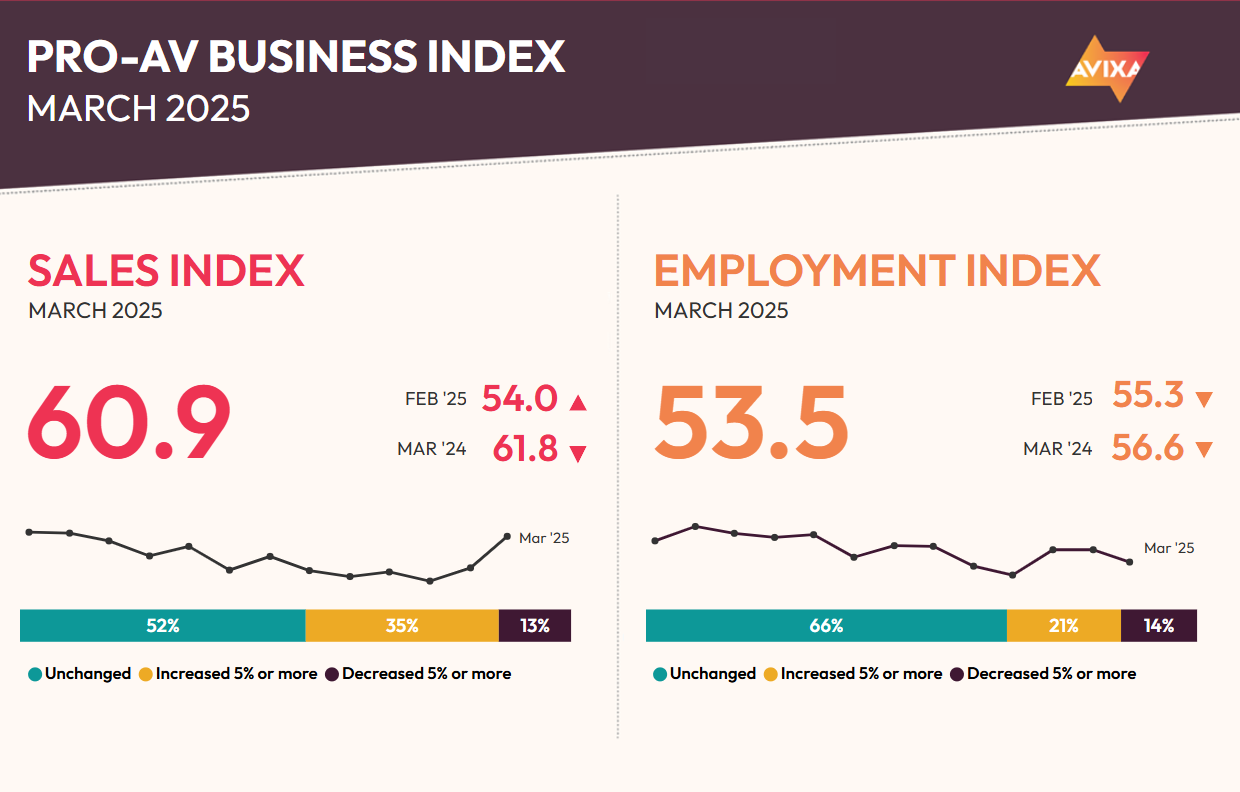

However, now there’s good news: The AVI-S leapt from 54.0 in February to 60.9 for March. This is very welcome positivity, though we should not expect it to continue. A substantial change in any direction that is unaccompanied by a clear cause usually reverts in the following month, and that’s what we anticipate here: back to mid or low 50s. That’s especially true given the intensity of trade conflict that is heating up between the United States and the rest of the world.

Tariffs (and their related uncertainty) were by far the top concern in the open-ended comments from our response pool—and that’s with almost the entire sampling period before President Trump’s April 2 tariff announcement. The massive tariffs on countries all around the world are a clear source of short-term pain for our industry. Perhaps there is a long-term strategy that will pay off, but for now, even though some have been paused or reduced at press time, they are a lingering negative that will drive prices higher in the United States.

The AV Employment Index (AVI-E) was a clear contrast to the AVI-S in March. After running ahead of the AVI-S so far this year (suggesting greater strength than the AVI-S was indicating), the AVI-E decelerated in March to 53.5. In previous months, the AVI-E was a reassuring counterpoint to a disappointing AVI-S; now it’s a splash of cold water on an exciting AVI-S.

Taking the whole first quarter’s data together, the AVI-S and AVI-E tell a story of an industry growing modestly. The growth is below historical rates but still meaningful. In wider employment news, the U.S. had a good result for its March employment report. Payroll growth was at 228,000, well up from 117,000 in February.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

It’s critical to note that this information is a valuable metric but a lagged one. In a hypothetical where we enter a recession, we should expect jobs numbers to look OK for some months before the true impact of the downturn begins to show. That’s not to undermine the good news in March, but rather to put in mind as we go forward in a world where a 2025 recession looks likely.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.