Pro AV Suffers Under Weight of COVID-19 Crisis

Just as this is a difficult time for the global economy, it is a difficult time for the AV industry. In AVIXA’s April Pro AV Business Index, survey respondents make it clear that the live events side of the industry is suffering the most, with almost all such business cancelled.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Just as this is a difficult time for the global economy, it is a difficult time for the AV industry. In AVIXA’s April Pro AV Business Index, survey respondents make it clear that the live events side of the industry is suffering the most, with almost all such business cancelled. Installation and design work are more of a mixed bag. Some organizations report good luck with continued revenue, while others report decreased revenue for now but cautious optimism about some small uptick in the coming weeks.

“New business seemed to take a pause for a month while the COVID-19 pandemic took hold. However, we’re starting to see requests for proposals and design work,” shared an AV integrator in North America.

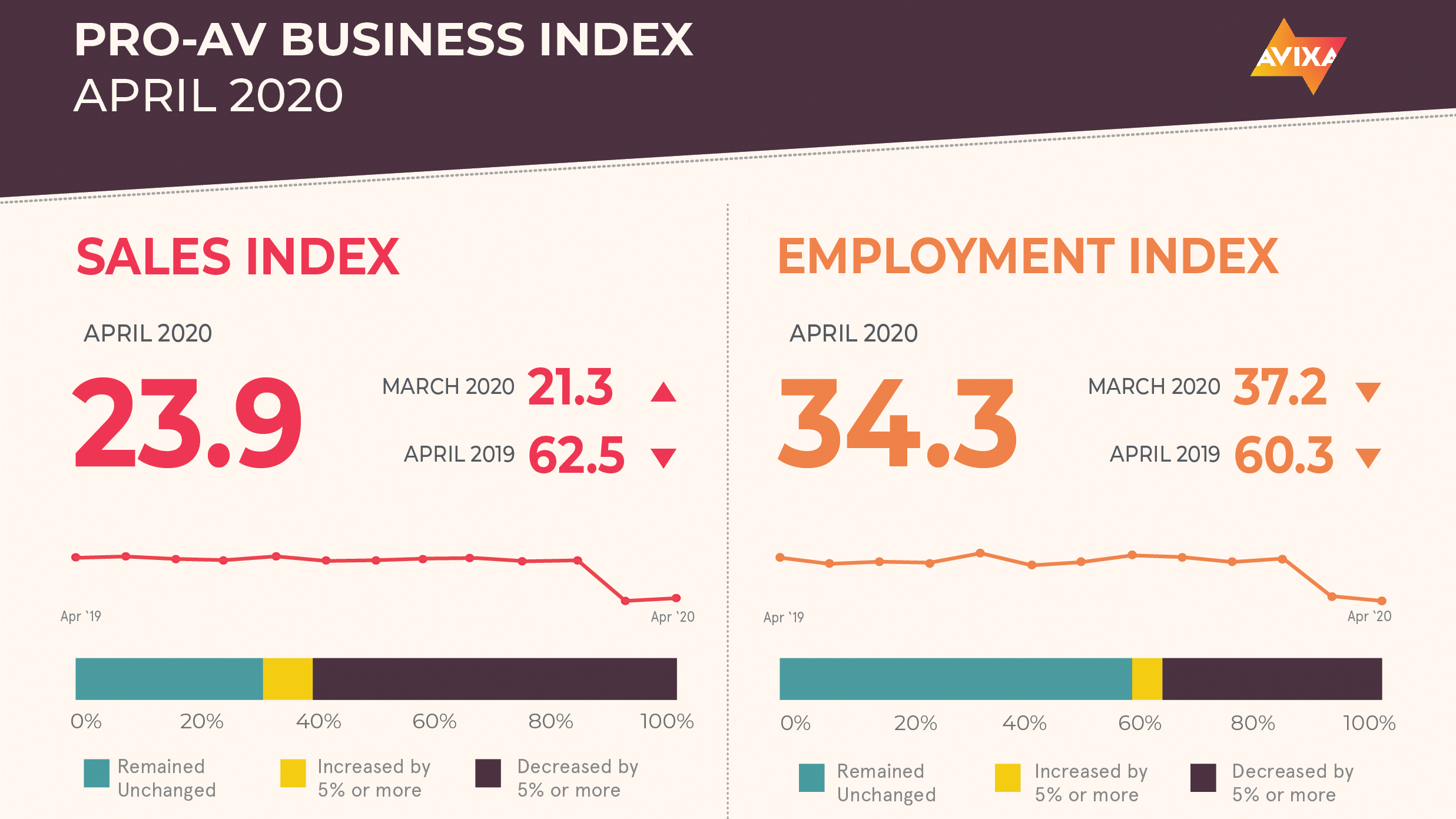

The April AV Sales Index showed continued contraction, clocking in at 23.9. While this number is a few points higher than March’s score of 21.3, it still far below the neutral growth mark of 50, signaling strong contraction in the AV industry.

Financial markets suggest COVID-19 uncertainty is subsiding, as the metric AVIXA’s Market Intelligence Team has been tracking over the last two months—the volatility index known as VIX—dropped below 30 for the first time since February. This is still certainly a high reading, but we’ve seen higher readings as recently as late 2018, which was a time of good economic health. This suggests a narrowing of future courses for the economy, especially the reduced likelihood of further major declines.

“Seeing uncertainty drop is good news for pro AV,” said Peter Hansen, economic analyst, AVIXA. “Businesses tend to hold off on investments in things like new construction and renovation when times are tough. Pro AV draws a significant percent of its revenue from maintenance spending that will happen regardless of uncertainty, but the uncertainty of the last two months has been tough on the industry. There will be lingering effects from delayed or cancelled projects, but decreasing uncertainty is the first step toward recovery.”

Employment numbers show the truly devastating impact of COVID-19. The U.S. Bureau of Labor Statistics’ (BLS) April report showed an unemployment rate of 14.7 percent, the highest since the Great Depression. A closer look at the data shows the reality is even worse than the single statistic suggests. To be counted as unemployed, respondents must be actively looking for a job, something many people may not do given the discouraging employment numbers and concerns about the virus. Indeed, if you compare the percent of Americans currently employed to the labor force participation rate from February, you get an unemployment rate of 19.0 percent. And these numbers likely do not yet show the full crisis impact, as the BLS survey captured data in the middle of April, and therefore does not reflect any worsening since then. Pro AV numbers tell a similarly disheartening story, as the AV employment index ticked down another 3 points to 34.3 (the neutral growth mark is 50).

AVIXA is here to support the pro AV industry now and always. For AVIXA’s latest information about COVID-19’s impact on the pro AV industry and helpful resources, visit www.avixa.org/COVID19.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

Follow Business Trends with AVIXA

- Pro AV Suffers Under Weight of COVID-19 Crisis (June 2020 SCN)

- Pro AV Feels COVID-19 Impact (May 2020 SCN)

- Coronavirus Shoe Yet to Drop for Pro AV (Apr 2020 SCN)

- Pro AV Sales Growth Slows at the Start of 2020 (Mar 2020 SCN)

- Pro AV Grows as New Decade Dawns and Brexit Looms (Feb 2020 SCN)

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.