AVIXA Report: Pro AV Continues Rapid Growth, Though Deceleration Continues

Supply chains remain an issue, but the continued increase of in-person activity is a positive influence on the industry.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

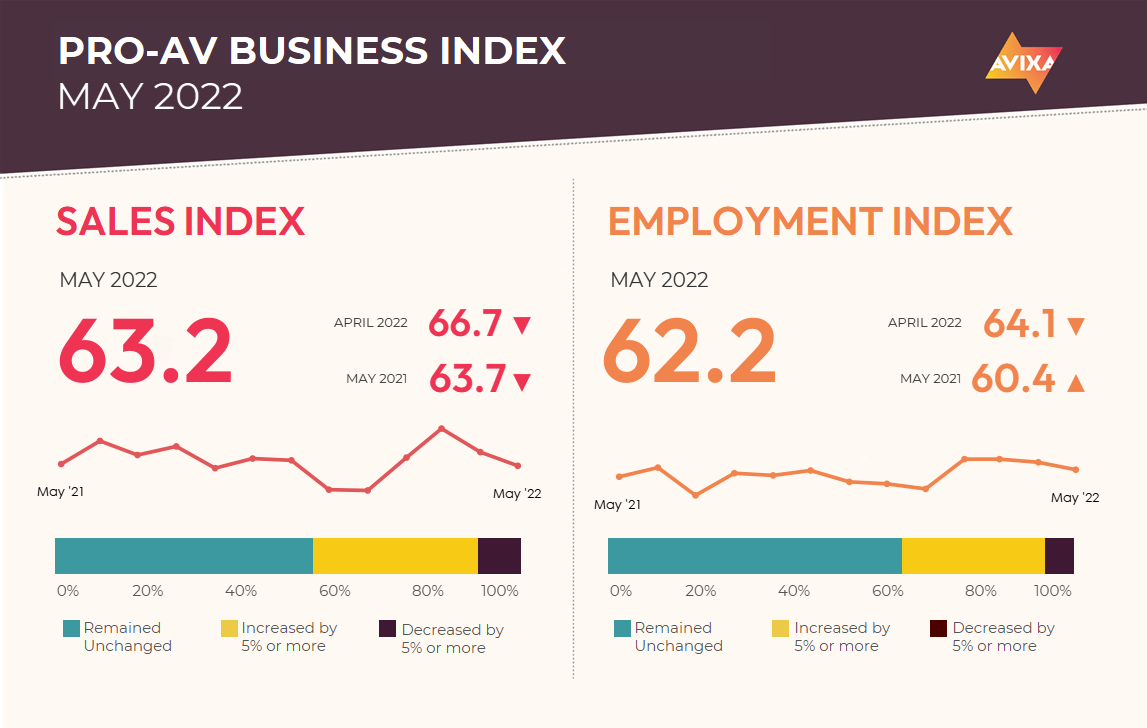

AVIXA’s latest Pro AV Business Index shows May as another month of rapid sales expansion, though with modest deceleration. The May AV Sales Index (AVI-S) came in at 63.2. Since the single-month record recorded in March (72.7), the AVI-S has subsided to a level that would have been high but not unusually so in the pre-pandemic era. This is a rate that might be described as strong but sustainable.

On the negative side, supply chains remained a top issue. This constraint was counterbalanced by many positives, one of which is the continued increase of in-person activity, with a chorus of cautious optimism from live events.

“Hybrid elements remain a driver of AV spending there,” said Peter Hansen, economist, AVIXA. “Technology improvements are also a part of the growth now, as solutions catch up to the new needs that have developed over the past couple of years.”

After Eurozone inflation numbers came in at 8.1% for the last 12 months on May 31, U.S. inflation numbers came it at 8.6% for the last 12 months on June 10. These are high numbers that pose an economic risk as central banks respond by raising interest rates to cool the economy down. The U.S. Federal Reserve has raised interest rates by 0.75% this year and the European Central Bank announced the first rate increase in 11 years to take place in July.

For Pro AV, this poses a risk to demand stemming from the risk of economic contraction. Pro AV prices are actually more stable than inflation. Inflation is being driven largely by fuel and food (since fuel costs are a substantial portion of food costs). Housing is a driver in the United States as well.

[AVIXA Officially Launches AVIXA Xchange, Connecting the Global Pro AV Industry]

None of these factors are particularly influential for Pro AV products. We’re not immune from fuel prices, but they’re just not a big percentage of total cost. That’s why AVIXA’s data shows flatter prices in our industry. For an in-depth look at Pro AV supply—including, delays, price change, and more—check out the Macroeconomic Trends Analysis (META) Q2 report at www.avixa.org/meta.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

As observed for the AVI-S, the AV Employment Index (AVI-E) decelerated modestly in May, from 64.1 to 62.2. Though the AVI-E is numerically lower than the AVI-S, it is relatively higher. Sales change more rapidly than employment does, making AVI-E numbers above 60 less common than for the AVI-S. This emphasizes the pace of AV payroll expansion we’re seeing right now.

The expansion is especially good news when considering the context. Right now, global labor markets are historically tight. For example, the May Employment Report showed the addition of 390,000 U.S. jobs against a steady 3.6% unemployment rate. This is strong enough on its own before noting that layoffs hit a record low in April and the gap between job listings and unemployed workers is at unheard-of levels. In other words, AV is having notable success recruiting despite an incredibly difficult recruiting market.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.