A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

AVIXA’s latest Pro AV Business Index shows 2021 ended on a so-so note, as the rising Omicron wave slowed AV sales growth in December. Survey respondents also emphasized the inconvenience of current supply conditions, including delays and increased costs. Another aspect that showed up more frequently was issues acquiring and retaining talent. The talent pool has been tight outside of AV for some time, and the tightness may be reaching our industry now.

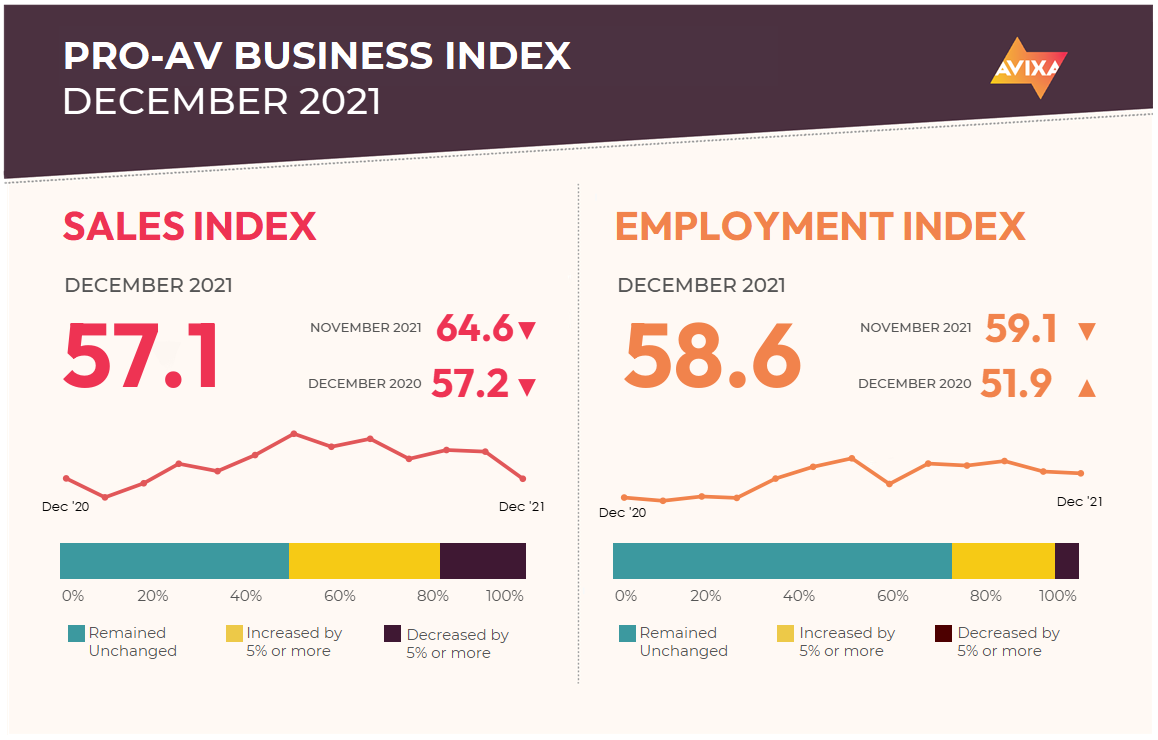

The AV Sales Index (AVI-S) registered 57.1, a level that has both good and bad aspects. On the good side, it’s above the no-net change mark of 50, meaning AV sales did increase in December. That also means that AV sales increased in every month of 2021, a welcome mark of positivity and consistency in a difficult time. The bad aspect of the 57.1 mark is that it’s a clear deceleration from growth in the preceding months. Both October and November saw AVI-S readings of roughly 65, and April 2021 was the last time the index was below 60, so December was indeed a marked reduction in the pace of growth.

[AVIXA Launches Online-Proctored CTS Exams]

Year-on-year, the latest numbers show massive increases in semiconductor manufacturing, with 23.5 percent more semiconductors produced in November 2021 than in November 2020. The increase has been so significant that an annual record for total production was already set in 2021, even with December yet uncounted. This shows two things for our industry: First, the chip shortage is not the primary issue with supply; continued effects of COVID-19—especially disruptions to the supply chain—are more significant. Second, it highlights how evolving demand is at the root of supply issues; quantity supplied has increased dramatically, but evolutions—revolutions, even—mean much more is needed. Manufacturing is complex and its capacity to adjust is finite. This story here with chips is true of many AV products as well.

[Employee Retention—Before “I Quit”]

In December, the AV Employment Index (AVI-E) showed a continuation of solid employment growth, registering at 58.6. This rate was nearly identical to the November AVI-E of 59.1, and it marks the ninth consecutive month of payroll growth proceeding at least at a moderate rate of expansion.

“That run of employment growth appears to be creating a scenario we warned about in last year’s second quarter Macroeconomic Trends Analysis [META] report,” said Peter Hansen, economist for AVIXA. “The 2021 Industry Outlook and Trends Analysis [IOTA] data showed how AV recovery was lagging the wider economy but gaining steam, and wider employment data showed an increasingly tight labor market. Our interpretation was that this implied that sooner or later the hiring squeeze would reach AV. This month’s survey comments suggest that squeeze is beginning. If you anticipate hiring needs in 2022, the sooner you move, the better. Hiring is not going to get easier.”

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.