Samsung and Harman Acquisition—Can it All Be About Automotive? What About Pro AV?

- The recent announcement that Samsung will acquire Harman for $8 billion has sent the newswires buzzing across the technology industry. Google this news and one comes across reams of press commentary, along with countless blogs from industry experts, Futuresource included.

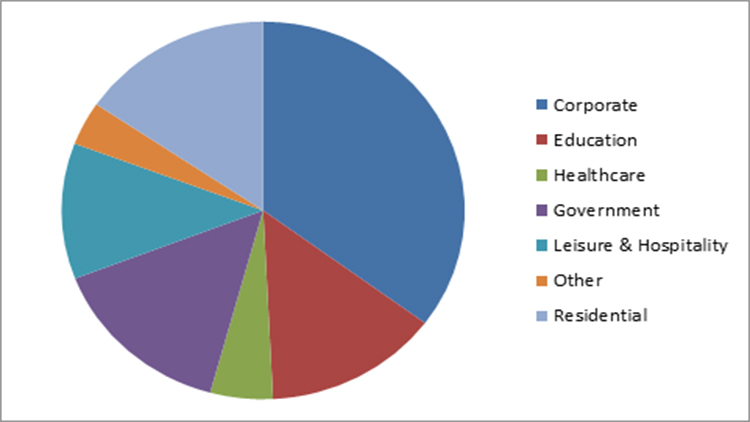

Breakdown of Matrix Switching Ports by Vertical—Global 2015 The story invariably focuses around the access Samsung will gain in the automotive sector or, more specifically, connected car solutions which accounted for approximately 65% of Harman's sales during the 12 months ending 30th September. For the record, there is absolutely nothing wrong with this, it's a mantra often preached at Futuresource 'opportunity and innovation is all around us in the tech industry, but where is the money being spent?'.

But we on the Pro AV side of this business sat up and took notice for a very different reason. Samsung is a serious heavy-weight in the Pro AV space or certainly in display technology, where it is clear market leader in LCD technology. However, and like many Pro AV display vendors (not just in LCD but also projection and LED), Samsung has a constant challenge to remain relevant in the planning and decision-making process. In a bitterly ironic twist, given the display is often the only part of a solution that an end user actually sees, the lion's share of project budgets tends to be spent on other solution elements. Display selection is regularly an area where corners are cut to fit project budgets. Couple this with the rock bottom pricing of TVs as an alternative to professional displays and the picture looks even more challenging.

For many of us in the industry, Harman means audio, and rightly so considering the slew of brands in its wheelhouse. Professional audio appears to be following the CE space, enjoying something of a renaissance in recent times, or perhaps just finally receiving the attention it should really always have enjoyed. This is actually closely reflected in the amount of work Futuresource has been undertaking in this space over the last two years. There are certainly some interesting synergies here for Samsung; brands like AKG, Crown, JBL Professional, Martin, Studer and Soundcraft potentially offer Samsung access to new accounts and channels. But much like automotive, whilst this is the more obvious story, for me it is opportunities in video distribution that piqued my interest.

As a bit of background, Harman acquired AMX in 2014. AMX is the third placed player in pro AV signal distribution and automation technologies behind competitors Crestron and Extron.

Video distribution solutions are a major portion of the business for AV automation companies, with these products accounting for around 50% of revenues across the major players. Matrix switching products, typically used to tie together multi-room systems, account for roughly half of this video distribution value and have been a major focus of growth and competition between providers in recent years.

These matrix switching solutions act as the heart of distributed AV systems, with various control systems and room-based technologies layered on top of the central video distribution network. As such, in large project opportunities, these systems are typically specified early on in the decision-making process as the complexity of solutions means that manufacturers will typically work closely with end users and integration partners. Samsung's acquisition means it will be able to push display products as part of the deal, early on in the project lifecycle.

This provides Samsung with greater access to customers across a range of verticals. The base of Samsung's displays business is heavily focused on retail, not a major market for matrix switching, and is arguably less strong in verticals like corporate, government, education and healthcare, where the majority of matrix switching sales are seen.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The other key story to this is the transition towards AV over IP, a very hot topic right now in the industry. The falling cost of Ethernet switches, improvements in compression and delivery technologies and a transition towards AV management through IT departments at an end-user level are all expected to increase the adoption of IP solutions in coming years.

Of the top three players in signal distribution, AMX seems to have been the most aggressive in its adoption of AV over IP. An indication of this was the acquisition of SVSI in 2015, estimated to be the leading player in low latency AV over IP solutions. Other major players have been less aggressive in their adoption of IP technologies as these solutions use off-the-shelf Ethernet switches and threaten revenues from proprietary card cages that conventional matrix switchers are based on.

This has the potential to offer AMX a competitive edge over other major suppliers who do not have a robust IP offering to complement conventional matrix switching solutions.

Chris Mcintyre-Brown is the Associate Director of Displays & Broadcast Equipment at

Futuresource Consulting. Chris has a background in marketing consultancy, helping clients in the public and private sector with strategic planning.