Pro AV Growth Strengthens as Vaccine Proliferation Promises Normalcy

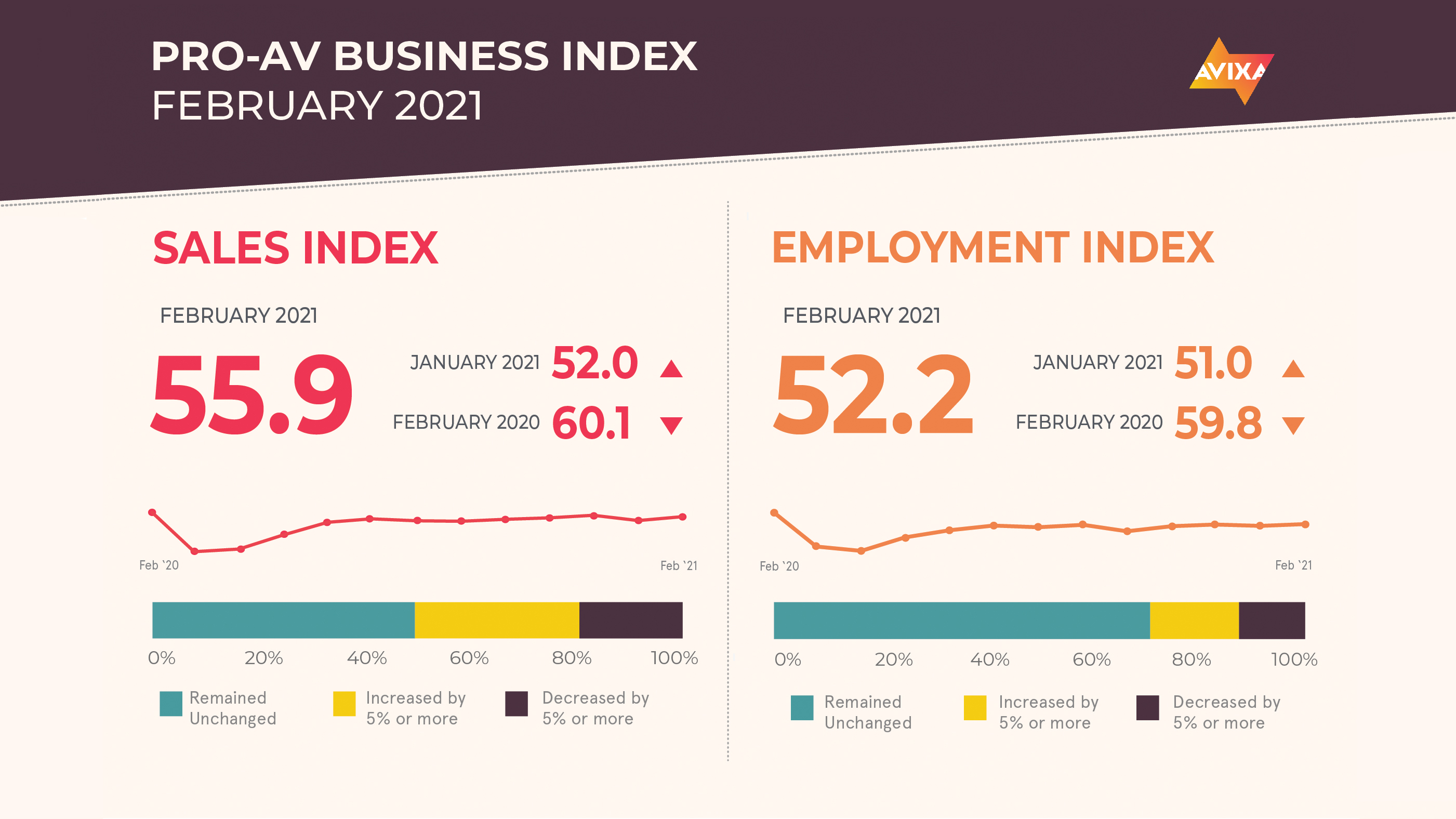

After a blip of deceleration seen in January, AVIXA’s Pro AV Business Index shows AV sales growth sped back up in February. The AV Sales Index (AVI-S) reading of 55.9 is a clear indicator of growth, although lower than typical pre-pandemic numbers and also lower than the pandemic recovery high-water mark of 57.2 that was recorded in December.

Though not as strong as it could be, the 55.9 mark is clearly good news. After the higher growth of December and the tepid growth of January, it was an open question how strong the AV recovery is. No, February’s result doesn’t signal a gangbuster bounce back, but it points strongly in the right direction. In that positive vein, many survey commenters cited growing signs of a post-COVID future, including spending to prepare for increased in-person activity and live events on the calendar in the foreseeable (if not immediate) future.

“It’s refreshing to see the index climb back into the mid-50s,” said Peter Hansen, economic analyst for AVIXA. “That’s a high enough level of genuine recovery rather than tepid growth or stasis. That said, the pandemic dug a huge hole for the AV industry last spring. To bounce back, we’ll need to get up to 60—the levels we saw consistently before the pandemic—and even beyond. 70 is a good goal if we want to get back to pre-pandemic business levels by 2022.”

In countries such as Israel, the United States, and the United Kingdom, it’s time to start working with clients to prepare for post-COVID business conditions. Vaccine proliferation in leading countries has resulted in extremely encouraging stats, like an 80 percent drop in the daily death rate in the United Kingdom and a 67 percent drop in the hospitalization rate in the United States. Continued progress is needed, and it will take time for comfort levels to adjust, but the signs are positive. Live events and travel are coming back soon! Many countries lag behind the U.S. and the U.K., with the EU in particular seeing stubbornly high COVID rates and slow vaccine progress.

In February, the AV employment index (AVI-E) hit a new high since the pandemic began, scoring 52.2. From a market measurement perspective, AVIXA analysts weigh employment fluctuations more heavily than sales fluctuations because employment decisions are long-term choices. Expanding the company payroll is a significant investment that takes a critical combination of financial strength, confidence, and optimism. That said, the industry needs more than the kind of modest growth indicated by a 52.2 AVI-E.

As in the wider economy, payrolls declined dramatically at the onset of COVID-19. So far, AV payrolls have stabilized more than truly bounced back. With the movement toward a post-COVID future, AVIXA analysts are watching closely for stronger growth in AV employment. In the U.S., economy-wide numbers paralleled the AV story. The latest jobs report showed solid growth—the addition of 379,000 jobs—but a huge deficit still to be closed, with nearly 10 million fewer jobs than a year ago. The recovery is strengthening, but for the jobs market, there is still an extremely long way to go.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.