Pro AV Growth Speeds Along Despite Economic Shakiness

From February to April, the industry set a new record for the fastest three months of growth.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

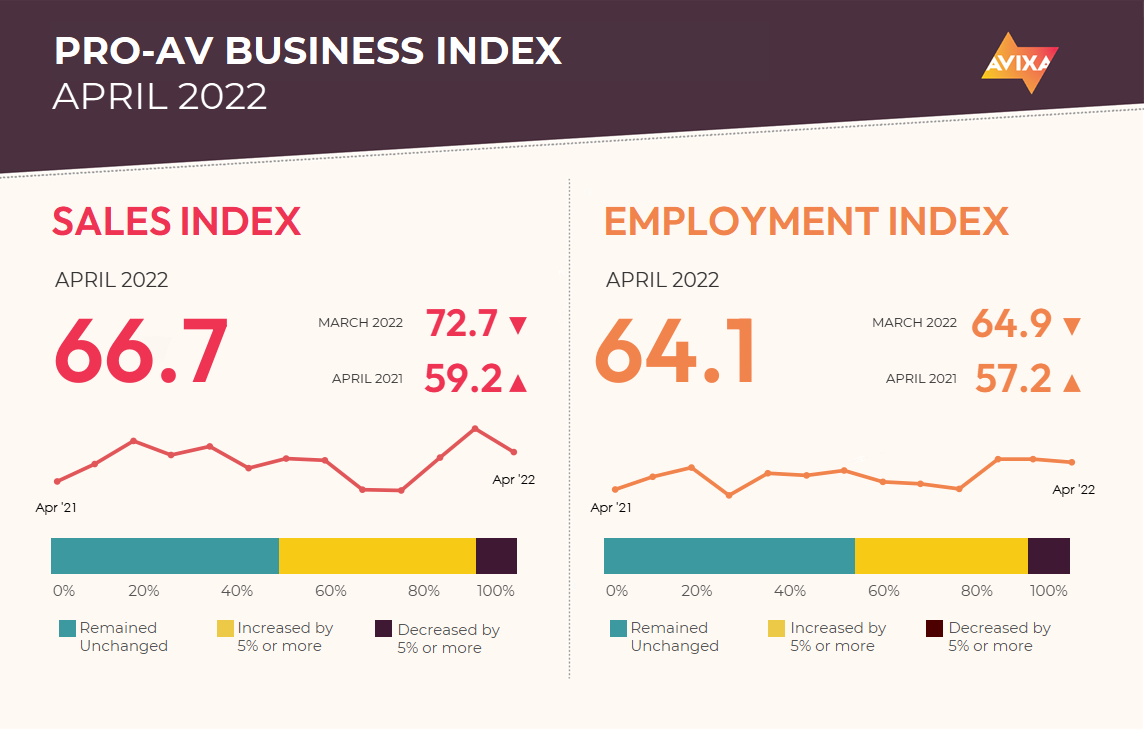

AVIXA’s latest Pro AV Business Index shows AV sales continued at a remarkably high pace in April, with the sales index (AVI-S) coming in at 66.7. This was a substantial deceleration from the single-month record observed in March (72.7), but it still indicates extremely fast growth. In fact, the period from February to April set a new record for the fastest three months of growth, surpassing the 2021 June/July/August growth boom prior to the worst of the Delta wave and the Omicron wave.

Commenters pointed first and foremost to the supply chain as a brake on growth, particularly long lead times. On the positive side, the return to in-person activity is driving sales. It’s finally reaching the most COVID-sensitive applications, too, with a wave of positive sentiments coming from live events.

Overall economic numbers in the first months of the year have been less rosy. U.S. Q1 GDP came in at a contraction of 1.5%. While the economic consensus suggests this is a product of temporary factors, declines in inventory purchasing due to preemptive purchasing in late 2021 and record highs in the trade deficit stand out as major contributors that are likely to be less negative in Q2.

“Why is AV so strong if the overall economy is less wonderful? Return to in person,” said Peter Hansen, economist, AVIXA. “Decreasing avoidance of situations where COVID-19 could transfer is spurring investment over and beyond what GDP is doing.”

Also less rosy were stock markets, especially in the tech sector and especially in April. The drop has been globally shared, as both U.S. and international markets have dropped some 17% since the start of the year. Another favored indicator is VIX, which measures uncertainty. The pandemic era has seen consistently high values compared to prior years, but VIX has moved from being in the 15-20 range for most of 2021 to spending weeks in the 30s in March and April.

Among other aspects, the market is nervous about the possibility of a recession. Recession is an increasing possibility, but Pro AV at least has the in-person return advantage. If that continues, we could see Pro AV growing even despite a modest recession.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

[Why It's Time for a Change for Integrators]

AV employment is growing as fast now as it has in the history of the AVI-E index. This month’s number was 64.1, right in line with the 64.9 observed in both March and February. Together, these months set a record for three-month payroll expansion—just as we saw for AVI-S. Commenters note that hiring is not easy, but clearly they’re managing to add meaningful amounts of staff despite the difficulty.

The wider economy also continues to see payroll expansion, as the U.S. economy added more than 400,000 jobs for the 12th month in a row. Given that a month of 200,000 new jobs was a good month in the pre-pandemic era, this job run is a strong positive. For more information, keep an eye out for AVIXA’s 2022 Channel Employment Report.

[Viewpoint: It’s Time to Reintroduce Accountability to Pro AV]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.