Pro AV Growth Slows, Reflecting Wavering Macroeconomy

While pro AV sales did show continued growth in September 2019, the industry situation reflected more of the broader economic mediocrity.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Last month’s Pro-AV Business Index was surprisingly strong against a backdrop of an uncertain macroeconomy. September was a little different. While pro AV sales did show continued growth, the industry situation reflected more of the broader economic mediocrity.

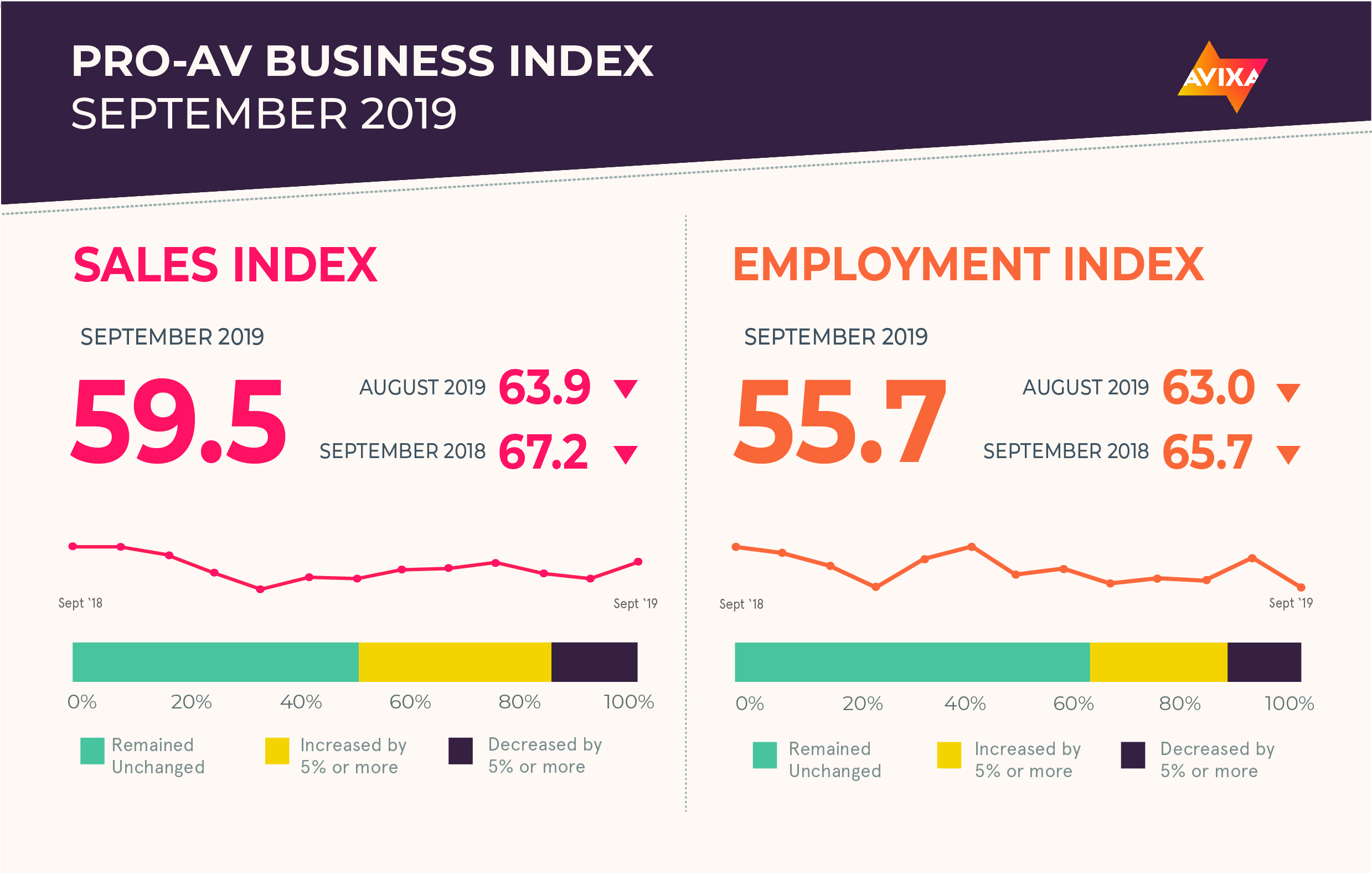

The AV Sales Index (AVI-S) clocked in at 59.5, down from 63.9 in August. In retrospect, the August number looks like a positive outlier, as June saw an AVI-S of 61.4 and July a reading of 60.3. Current readings are down from last year, when the AVI-S was up over 65 in the summer and early fall.

“It’s always disappointing to see the AVI-S drop from month to month, but overall, readings around 60 must be interpreted as good news for pro AV,” said Peter Hansen, economic analyst, AVIXA. “In our Industry Outlook and Trends Analysis, we project pro AV to outpace economic growth, and these scores of 60 during such a lukewarm economic environment suggest pro AV is doing just that.”

As expected, many Pro-AV Business Index survey respondents spoke of concerns over trade issues. Other common subjects were the challenges of staffing and the highly competitive marketplace.

“The market feels to be struggling with Brexit uncertainty, budget constraints, and project delays, but also with smarter users and IT brands adding features that compete with traditional AV functions,” shared an AV distributor in Europe

The widely followed U.S. manufacturing purchasing managers’ index from the Institute for Supply Management clocked its lowest reading since June 2009. The disappointing mark knocked a couple percent off stock market indexes worldwide and signals two impacts on pro AV. First, trade-generated manufacturing problems are driving price increases and uncertainty, which make projects difficult to price, especially since end users don’t want to pay more for hardware. Second, high prices and manufacturing problems create economy-wide difficulties that affect buyers of AV equipment. In an unsteady economy, end users will hesitate to invest in AV upgrades.

The September jobs report in the U.S. looked very much like the August report, with 136,000 employees added against a prediction of 145,000. The unemployment rate dropped to 3.5 percent, which is the lowest since 1969. However, business leaders should not read too much into that statistic as its implication—a strong and exceptionally tight labor market—is contradicted by the fact that hourly wages remained flat from August to September. This leads to an annual wage increase of 2.9 percent, the lowest rate since July of 2018. Pro AV saw a disappointing month for jobs, with the AV Employment Index measuring 55.7. As with the AVI-S, August showed a strong reading (63.0) that now looks like an outlier, since the month’s number is in line with the July figure (57.3).

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.