AVIXA Report: How Mixed Economic Signals Are Impacting Pro AV Growth

While GDP signals the economy has weakened so far this year, are we actually in a recession?

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

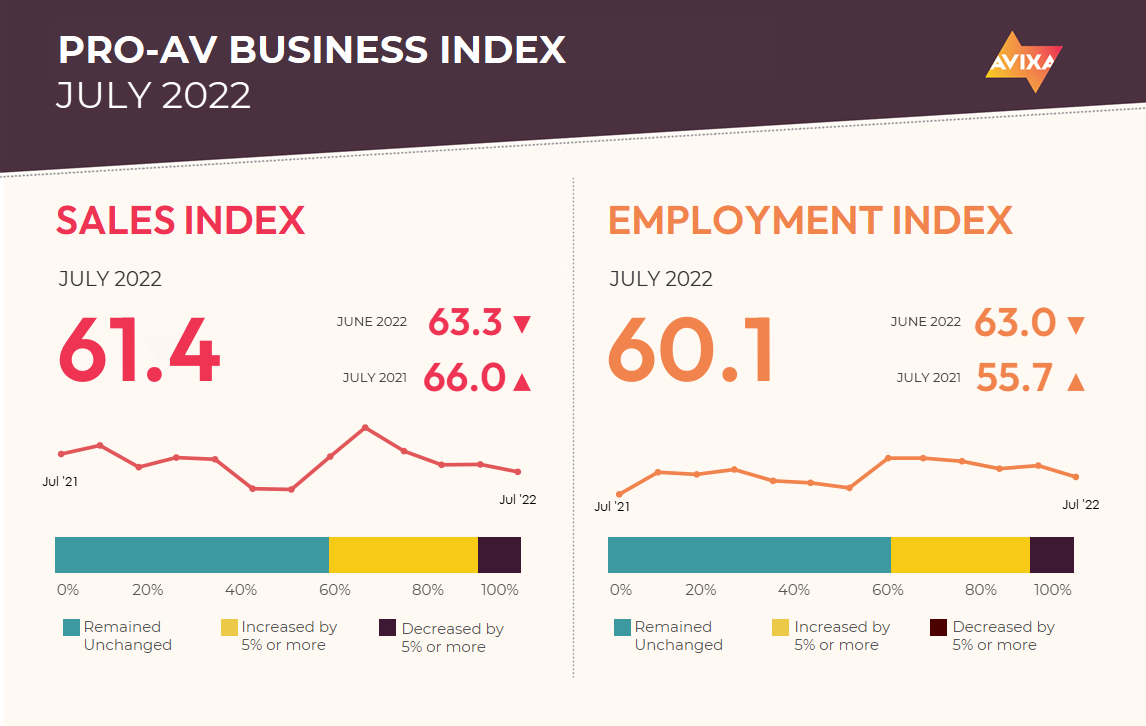

In AVIXA’s latest Pro AV Business Index, July marked another solid month for the Pro AV industry, as the AV Sales Index (AVI-S) measured 61.4. This is a slight deceleration from the June mark of 63.3, but it remains well above the no-net change mark of 50. For historical context, numbers near 60 were common in the years leading up to the pandemic.

“Comments from our survey respondents indicate that the barriers to faster growth remain on the supply side, with a lack of available skilled workers and especially long lead times on certain products slowing project work,” said Peter Hansen, economist, AVIXA. “Demand appears to have come down since the initial, return-to-in-person driven burst in spring, but it remains beyond what most companies can meet with their current staffing and product access.”

U.S. second-quarter GDP numbers came out in late July, revealing a second consecutive quarter of contraction. Sometimes, two consecutive quarters of GDP contraction are offered as a technical definition of recession. But are we in one? The answer is an easy no.

Yes, GDP sends a negative signal. But a broader look at economic signals shows tremendous strength and growth. One indicator we track in our index reports is U.S. payroll expansion. Even before the remarkable job growth observed in July (more on that later), the economy had added some 2.8 million jobs in the first two quarters of 2022. If that’s a recession, we should have more of them!

[AVIXA Views: Samantha Phenix]

Further evidence for why the “two consecutive quarters of contraction” definition is weak: By that definition, COVID-19 didn’t cause a recession. U.S. economic activity peaked at roughly the end of February 2020 and bottomed out near the end of April 2020. Only two months of contraction. But that was undoubtedly a recession, as the economy suffered its worse GDP reduction since World War II.

In sum, while GDP signals the economy has weakened so far this year, an overall look reveals considerable economic health. A recession may come, but it is not here yet.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

Like the AVI-S, the AV Employment Index (AVI-E) showed good expansion in July, though again at a slower pace than in June. The AVI-E measured 60.1, down 2.9 points from its June mark of 63.0. As we noted in June, the AVI-E typically is closer to the no-net change mark of 50 than the AVI-S, since payrolls are steadier than sales. In that context, it’s unsurprising to see the AVI-E decelerate more than the AVI-S did.

[Why It's Time for a Change for Integrators]

Over the coming months, we expect to see the AVI-E fall further below the AVI-S, aligning closer to historical norms. The U.S. July jobs numbers came in remarkably strong. Payrolls added 528,000 jobs, more than doubling expectations of 258,000. Unemployment has reached its February 2020 level at 3.5%, the lowest level since 1969.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.