AVIXA Report: Moderate Pro AV Growth Continues

The industry seems to be settling in to a modest expansion phase, but economic and supply chain fears still linger.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

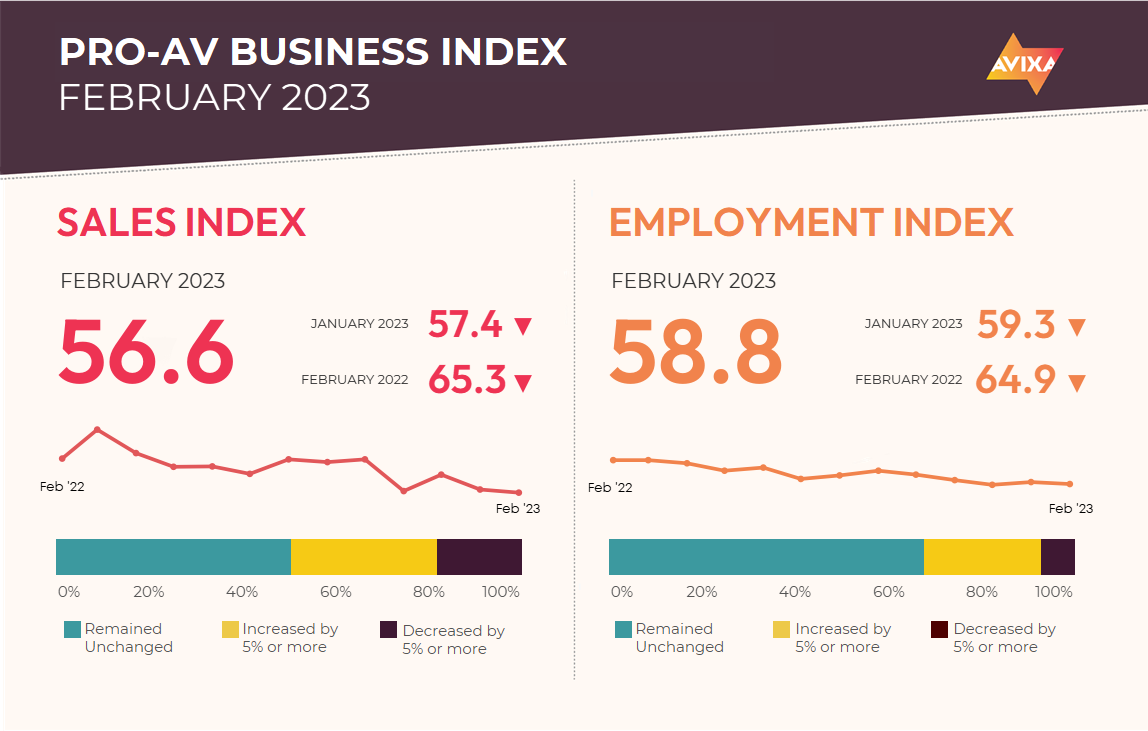

With the economy slowing and the return to in-person boom mostly exhausted, Pro AV growth seems to be settling into a moderate expansion phase, according to AVIXA’s latest Pro AV Business Index. After February’s AV Sales Index (AVI-S) reading of 56.6, three of the last four months have been within a half point of 57.0. This level is above the no-net change mark of 50, but it is lower than historic norms for our industry.

[HETMA and AVIXA Get Physical]

Comments from survey respondents elaborate on why Pro AV is at this level. Several point to growing steadiness in month-to-month sales after a frenzied 2022. For some, that meant contraction in February simply due to randomness.

Supply remains the most significant challenge, though the situation continues to slowly improve. Economic fears are also a factor, both in the form of already realized weakness and hesitancy to invest due to fears that things could get worse. That said, given the continued revenue growth, the positives clearly outweigh the negatives.

March began with an old-fashioned economic bump: a bank run. Modern regulations and insurance schemes have made such occurrences rare, but on March 10, a confluence of several factors—concentration in the recently hurting startup, crypto, and tech sectors, as well as a large percent of deposits uninsured, losses on excess assets, etc.—led to the failure of Silicon Valley Bank and Signature Bank in the United States.

[Viewpoint: How Fast is the Pace of Technological Progress?]

Such failures are concerning; Silicon Valley Bank is the second largest bank ever to fail. But realistically, these failures are unlikely to lead to any systemic crisis. For one, the traits that hurt them—especially their tech sector startup concentration and high percentage of uninsured deposits—are fairly unique. Major banks are far more diversified and hold far more insured deposits, while other undiversified banks are in healthier sectors.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

Beyond that, the relevant U.S. institutions (the federal government, Federal Reserve, and FDIC) have stepped in to guarantee the uninsured deposits. This should stop the future “get my deposits before it’s too late” waves that cause bank runs and collapses.

The AV Employment Index (AVI-E) continued to exceed the AVI-S in February, as it registered 58.8. As in January, this reflects that employers are continuing to catch up on hiring after a busy and difficult-to-hire 2022. It also reflects a lower rate of contraction.

In a steady state, month-to-month randomness means many businesses have down months. But payrolls contract far more rarely. The outsize strength of employment is not a Pro AV-only phenomenon.

[Taste the Rainb-over-IP? AVIXA, Skittles, and Planning for AVoIP]

February wasn’t quite as eye-popping as January, but it still showed payrolls are the bright spot of the current economic environment. The economy added 311,000 jobs, and labor force participation increased enough to lift the unemployment rate from 3.4% to 3.6%. This is about as good a report as could be expected, as it shows strength in the form of the huge payroll expansion and easing tension in the form of the increased labor force participation. We certainly hope such positivity continues in March.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.