New-Generation Video Walls Define the Global Market

Evolutions in video wall displays exert changes on application use.

Last year was a stunning display of growth for the global video wall market. In a report issued earlier this summer, market research firm FutureSource noted that the video wall sector reached a global market value of $6.4 billion, under-scoring a 47 percent year-on-year growth across three major video-wall technologies: rear projection cubes (RPC), LED, and LCD.

The report charts a strong competitive field with RPCs stilling leading the charge thanks in large part to their importance in control rooms, where they are noted for their reliability and suitability for mission critical applications.

“Once the newer technologies can improve their reliability, RPC’s market share will begin to drop, but this isn’t going to happen immediately,” noted Graham Cooke, FutureSource analyst, in reference to a minor decline of eight percent of 35,8000 units sold, which is highlighted in the report. “Even by the end of the forecast period, volumes will still be about 20,000.”

However, the demand for LCDs and narrow pixel pitch LEDs in the video wall market is showing significant growth; LCDs reached 1.3 million units this year, a 45 percent growth spurred on by their strong foothold in public displays and digital signage, while NPP LEDs saw a value growth of 50 percent to reach $1.7 billion, according to FutureSource data.

The factors surrounding the growing impact of all of these technologies vary and include price drops, integration of new and evolving technologies such as flip chips, smaller pixel pitches, and shrinking screen sizes along with the raising of the aesthetic bar, more vendors joining giants like Samsung and Sony in the market, and an expanded integration field that has taken new approaches to showcasing video walls, especially in DOOH, large venues, and commercial space applications.

“The appetite to display large images has always been there but until recently, the ability to do this, critically at an affordable price, has been missing,” Cooke told DSM. “The last decade has seen the introduction and evolution of LCD and LED video wall technology, coupled with infrastructure—software, players/controllers, content, etc.—to drive them.

“Hardware price declines have been rapid and matched by impressive developments in the performance of the technology, both of which make video walls more attractive and accessible for end users,” Cooke added. “Accessibility and familiarity are two key points with LCD, and to a point LED, solutions moving beyond project-based business and toward more of a run-rate model. Moving the needle towards more of a run-rate model drives scale which fuels the cycle.”

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

INTEGRATION IMPACT

In a recent video segment highlighting the evolving OOH sector in the UK, CNBC reported that the introduction of digitized OOH advertising has significantly reshaped that market, with large telecom investments and digitization lending a boost to what was a stalled sector (in addition to an EU opt-in mandate called General Data Protection Regulation (GDPR) that is impacting how the UK DOOH channel is reaching audiences).

“It will take 20 to 30 years for everything to become digitized, but I think that is the direction of travel,” noted Aiden Neill, founder of OOH company BitPoster, in the video segment. “I think that the nature of how the screens will be used will vary between the different screen types. But in terms of operational cost to run a digital screen we are now at a point where even if you were putting the same content up for a two to three-week period it would be more operationally effective to have a digital screen than have a poster network that required somebody to go put a poster up.”

For integrators with a hand in DOOH this is all good news. As more flexible screen sizes, lower screen costs, and more effective technologies drive audience interaction, video walls are finding a comfortable home in the sector, a shift that Chris Mascatello, EVP and head of commercial at ANC, a digital signage service provider, said is the number one driver in the uptick in video wall demand and popularity, not only in DOOH but also in more commercial and large venue environments.

Mascatello’s viewpoint is echoed by Emile Van De Coevering, creative director, Socialure, who noted that making a bigger impact at a lower price point is driving the integration of video wall in increasingly unconventional spaces. “More importantly, it’s because it allows you to customize your space for events, sales, holidays,” Van De Coevering added, “as opposed to a static fixture or art installation.”

INNOVATIVE INTEGRATION

With video wall installations proving so popular and with even more dynamic growth on the horizon, how displays are integrated becomes even more significant. Already impressive by virtue of their design and scalability, it is little wonder that aesthetics is a key factor in how new and next-generation video walls are being pushed to the market.

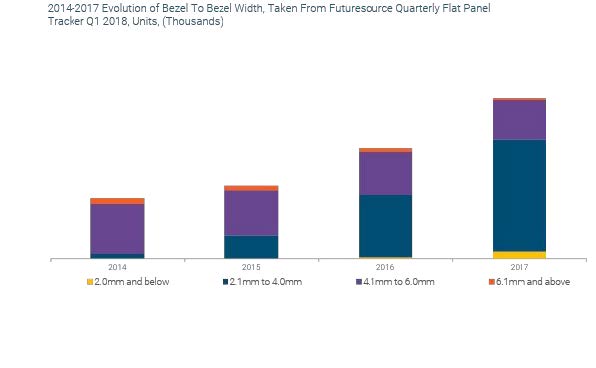

On the LCD side of the display spectrum, Cooke’s assessment that decreased bezel width is the “hot topic” in LCD video wall integration as end users grow averse to obtrusive crosshairs across the content is supported by the newer displays coming to market.

“At present the smallest commercially available bezel to bezel is the 1.2mm from LG, but is very recently launched,” Cooke said. “The market generally is sitting at 1.7-1.8mm Bezel to bezel (B-To-B) as the smallest accepted bezel. However, by the end of the year/start of 2019, there is expected to be sub-1mm bezel joins. Having said this, the Extreme Narrow Bezel category is slow to take off, and the volume still sits in the Ultra Narrow Bezel cat-egory (2-4mm B to B). However, with decreasing bezel widths, the fragility of the product increases, making it much more difficult to install, with integrators having to be very careful of touching the displays.”

But LCD displays might take a knocking from fine pitch LEDs, which are gaining ground in large scale video wall applications. As noted by Mascatello, this predicted shift will come at the expense of projection and tiled LCD walls because each has limitations that LED eliminates. “This includes maintenance and brightness for projection and brightness and seams for LCD,” Mascatello explained. “From a physical standpoint, the development of thin packaging for LED displays gives us more avenues to install screens and not have to worry about ADA depth of protrusion requirements.”

Cooke agrees that pixel pitch remains important but noted that there is a slow-down in the race to achieve even smaller pitches, with P1 .2mm to P1 .5mm currently the sweet spot for most applications while sub P 1mm pitches suffer from a lack of quality and too-high price tags. “For applications like retail, where viewing distance is large, then a larger pixel pitch is generally good enough,” Cooke said. “Beyond pixel pitch, we see durability becoming a more important topic in LED with new solutions coming to marketing that will bring customers/consumers/end users closer to the screen.”

CHALLENGES TO GROWTH

As the video wall market opens up to accommodate more commercial, large and advertising spaces, integrators are now tasked with finding exceptionally creative ways to capture and influence audiences that might have grown accustomed to a visually intense and digitized landscape. This is on top of making project-defining display choices, deployment schemes, and content rosters.

“Content is critical to a successful execution,” Mascatello said. “We are past the days where size and scale alone will wow viewers. You need to have great content and a unified presentation to really make a memorable experience. Support assets like lighting and audio are also critical components of experiential design.”

For Van De Coevering, pre-planning projects should be a key priority for integrators specializing in video-wall installations, no matter the size. “The sooner the integrator can get involved, the better the eventual solution,” he advised. “Working together with the designers, architects and project planners to create more inter-esting installations from the start. And it should go without saying that this counts for the creation of content as well.”

Coupled with content and deployment is, of course, the impact of the video wall itself. Cooke challenges integrators and designers to literally think outside of the box, especially as newer video wall displays accommodate previously unheard-of configurations, to lend an even more visually enticing appeal.

“It doesn’t have to be a rectangular installation anymore, there are many examples of unusual or different installs, where different shapes are created,” Cooke said. “Even simple things like having a mix of landscape and portrait displays mixes things up and makes for an unusual display. Likewise, with LED video walls, the potential installations are endless, and not as limited to a set shape. Shapes like curved displays are possible, opening up many new opportunities.”

Llanor Alleyne is an artistic editorial professional with proven success in developing, managing, and executing a wide range of creative and editorial processes. Her diverse editorial and artistic background encompasses a strong work ethic and a commitment to interrogating and addressing cultural, environmental and technological mores and norms impacting global change.