Rethinking the “Below the Line” Ad Spend

- Retail according to Wikipedia: “the sale of goods and services from individuals or businesses to the end-user.” Shopping: “the act of buying products”. Go deeper and they list out the types of retailers by marketing strategy. Way, way down the list, just above vending machines, is Etailers. You’d think this was written 20 years ago—and it’s indicative to the struggle many retailers are facing today.

I’ve been living and breathing retail for over twenty years. I, along with anyone in the industry, was raised on the tried and true strategies for success we’ve always adhered to—the 4 P’s (product, price, place, promotion), the science of signing, creating experiences and communications by zones, demographic profiling, etc. There have always been specific methods for successful retailing, all them rooted around selling in physical stores.

Fueled by the new needs of an informed, empowered, connected and expectant consumer, the retail industry is dramatically changing. Shoppers love technology and the power position it’s put them in and they, not retailers, are reinventing the rules. Examples:

•50% of packaged goods shoppers visit a retailer’s website one or two days before visiting the store.

•Shoppers now easily scan a bar code in a store with their smartphones and shop for a better price.

•As eluded to when it first emerged, Microsoft’s gaming platform Kinect is now being used to create virtual fitting rooms where 3-D models of our bodies can try on clothes online.

•Apps like Shopbee and Tweetalicious help shoppers easily find deals and discounts from the brands they love (or might love) with one click.

•Social shopping is becoming mainstream and the social players are upping their game. Shoppers actively “like” and share, many uploading photos for group votes (sometimes right from the dressing room mirror), and Facebook aims to become a shopping portal.

•Sites like Pinterest and Polyvore are changing the game regarding how we get inspired, find things “just for me”, gather group opinion, buy and share. And they are addictive. Polyvore appears to be the first public play based on Google’s ‘boutiques.com’ that was quietly in the market last year and it is truly industry-breaking.

•M-commerce is coming on strong and 2013 will be the year for mobile wallets. Paypal is already being tested at a small number of retail sites right at the POS. Facilitated via unique ID input or scanning a physical card now, it won’t be long until it’s also mobile. Same for Google Wallet; it makes buying with ‘one click’ possible regardless of place.

•NFC (near field communication) will be available on millions of handsets in 2015, making it easy to tap a phone on anything, anywhere to get the information that’s desired. Combine this with loyalty and mobile wallets and you can just imagine how it will change shopping as we know it.

I could go on with this list of course. And we all realize that in six months there will be more compelling shopper technology tools out there, and bricks-and-mortars will be forced to make them part of their retail strategies.

So here’s the gist. The definition of what retail ‘is’ has not changed as a result of all of this—it’s still the sale of goods and services from individuals or businesses to the end-user. It’s shopping, the act of buying products and serves, that’s changed. We now shop and buy in a world of virtuality, where the physical and the digital are one blended experience. There is no above the line and below the line—there’s no line! But retailers often still define, strategize and spend as if there is because they don’t have a trusted, reliable method to do it any differently.

Jim Lecinski, Google thought leader, friend and author of “Winning the Zero Moment of Truth: ZMOT” was the first person to really dig into this topic. Springing from P&G’s First Moment of Truth or "the three to seven-second window of time when a consumer notices a product on a store shelf," ZMOT recognizes that a moment happens before this when a shopper researches a product or service digitally. Rarely are these behaviors either online OR offline—they are many times both.

Nikki Baird of RSR Research studies this topic intimately. She sees that retailers think of themselves as selling products, and it's way too narrow of a view—they should be about enabling consumers' lifestyles. Amazon and other digital platforms have gotten very, very good at selling products. So the store – and the retail brand overall – needs to be much more.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

“We see that retailers are starting to ask their marketing departments to do a lot more than just buy circulars or negotiate ad space or air time. But I think the biggest change that technology is having on the definition of retail is disassociating the "buy button" from the retail storefront – truly whether online or in a store. If you think of "pressing the buy button" as the equivalent of, as a consumer, deciding that you're going to purchase and all that's left to do is pay – it used to be that the buy button was only available in stores. Then online and in stores. But now it's possible to put that buy button everywhere – including on consumers' phones. Embedded in advertising on the street or TV via 2D barcodes or short codes or soon to be NFC. And so it raises a fundamental question about what value the retailer is really adding to the equation. If you can buy it while waiting for a bus or a train, why should the retailer be the owner of that experience? Why not the manufacturer?”

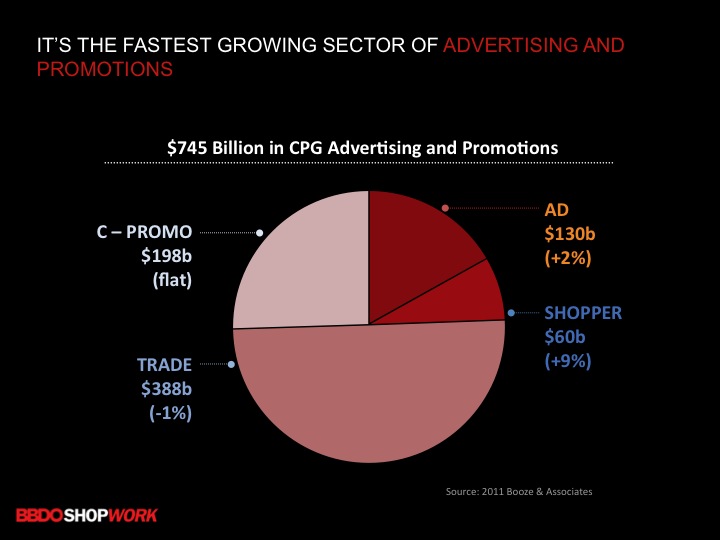

Great points, all supporting that retailers need to get away from thinking above vs. below the line and embrace a mentality of overarching strategic investments.

“In this sense,” Baird shares, “we're seeing more and more retailers realize the need to treat their cross-channel activities as strategic…but a lot of what they're actually executing is still one-off, reactionary tactics. Plain and simple.”

Laura Davis Taylor is Senior Vice President, Managing Director, at BBDO ShopWork.

Laura Davis-Taylor is chief strategy officer of InReality, a venue analytics platform that makes generating the most important placebased metrics easy. Their platform harnesses most any IoT tracking, measurement and influencing technologies to deliver the KPIs you need most.