AVIXA Report: Sales Growth Rebounds as U.S. GDP Stuns

The expansion is solid, but integrators are still being impacted by nagging supply chain issues and other economic factors.

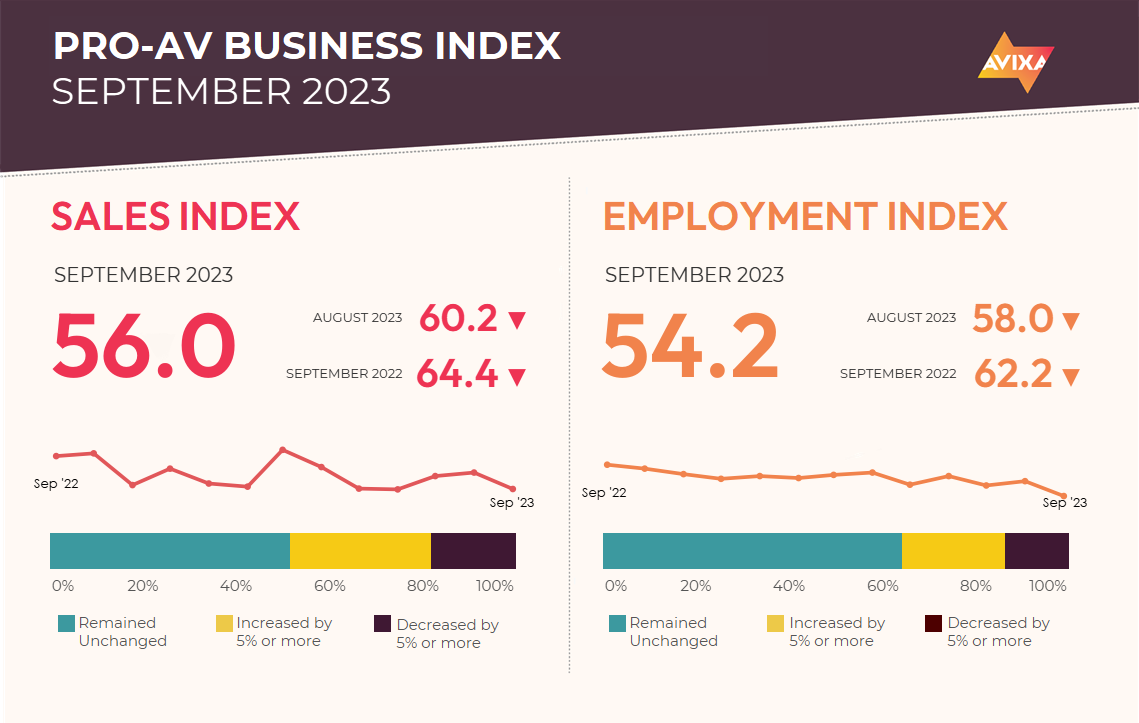

After a disappointing September, the October AV Sales Index (AVI-S) rebounded a few points to 58.8. This level is exactly in line with the average AVI-S this year and represents moderate growth that would be a little lower than was normal during the pre-pandemic era. As such, it should be seen as solid but unspectacular expansion.

[On Your Business: Purpose Before Profit]

While the data is clear that supply chains are improving, comments from survey respondents underscore that this remains a thorn in the side of many businesses. Broader economic factors also impact businesses, with uncertainty one of the leading challenges. Most companies are caught up on hiring after a burst due to the record revenue growth in 2022. However, those still hiring this year face challenges depending on location, role, and compensation structure.

“It’s enough to knock me over with a feather.” This was the view of a lead U.S. economist in response to the shocking third-quarter U.S. GDP report, which showed an annualized rate of 4.9%. This is exceptionally high, especially in what was supposed to be a down year. Add in that the first two quarters saw rates just over 2% (a normal, healthy rate for the United States), and 2023 looks likely to be an overall strong year.

The United States is not the only area with good GDP news. After China issued a $137 billion bond issue to support local governments and bolster the economy, the IMF significantly increased its growth outlook for 2023 and 2024 (both increased by 0.4 percentage points). Uncertainty remains going forward, and there is consensus for weaker U.S. GDP growth in 2024, but these gains are a major positive for the global economy and Pro AV.

The rebound in the AV Employment Index (AVI-E) was even stronger than that in the AVI-S. The AVI-E accelerated 5.1 points from 54.2 to 59.3. That puts the AVI-E higher than the AVI-S and puts its growth rate at a level that would be perfectly normal in pre-pandemic times. By illustration, this month’s score is the exact same as the full-year average AVI-E in 2017. Such a high level may be hard to sustain in the coming months, as the AVI-E has stayed at or below 59.3 since April, and the AVI-S, while solid, suggests slower payroll expansion than the rate observed in October.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

A look at the U.S. economy overall reveals continued strength. The unemployment rate ticked up to 3.9%, but the increase reflects increased labor force participation rather than a slowing job market. In terms of total jobs, the economy nominally added 150,000 jobs. However, a more realistic figure is 195,000, as 45,000 jobs were temporarily off the books in October due to the UAW strike. 195,000 is a strong expansion consistent with a healthy, growing economy.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.