AVIXA Report: Growth Continues in November

Good news for the AV industry in the latest Pro AV Business Index.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

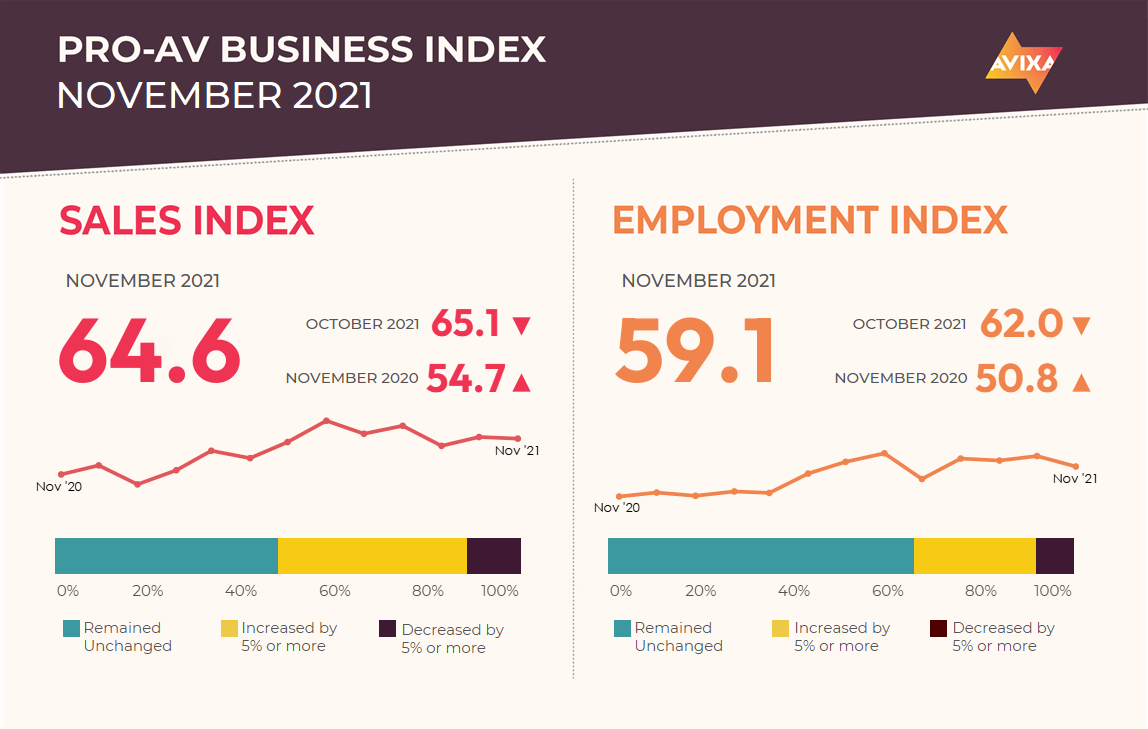

AVIXA’s Pro AV Business Index shows the positivity of rapid growth observed in October continued in November, as the AV sales index (AVI-S) maintained its high level. At 64.6, the November AVI-S was just 0.5 points below the 65.1 observed in October. The bottom line for both months is rapid growth that’s comfortably above historical norms. For historical comparison, in November 2020, the AVI-S was 9.9 lower at 54.7 (which was then the highest level since the start of the pandemic). In November 2019, the AVI-S was 2.8 points lower at 61.8, and it was 3.1 points lower at 61.5 in November 2018. The two most commonly cited challenges were—as usual in the second half of 2021—COVID-19 and supply chains. In a welcome signal of normalcy, many commenters also pointed out typical seasonal factors, such as an end-of-year spending push or a quiet season due to the approaching holidays or winter.

Omicron is the top concern on most minds now as uncertainty about the new variant’s severity and ability to evade existing immunity spurs fear. Equity market data suggests that the concern for business overall is not too significant. As of Tuesday, Dec. 7, the S&P 500 was less than 0.5 percent below its level prior to the announcement of the omicron variant. International markets were weaker, but even those were less than 2 percent below their level immediately prior to the omicron announcement. This doesn’t rule out concern, but it is real-time data that directly contradicts fears that omicron will have a substantial adverse effect on business overall.

AV employment continued to grow in November, though at a modestly slower pace than in October as the AV employment index (AVI-E) eased from 62.0 to 59.1. A common thread in comments has been about workers leaving the AV industry. Currently, AV recovery lags behind overall GDP recovery due to our industry’s reliance on in-person activity, so it is to be expected that workers would seek their fortunes elsewhere. Such shifts have been seen within the AV industry, as shown in AVIXA’s labor market research in the second quarter Macroeconomic Trends Analysis (META) report. That research, “Schrödinger’s Labor Market,” showed that our industry had diverged into haves—generally, those facilitating remote connectivity—and have nots—those in in-person centric industries such as live events and hospitality. The omicron variant adds further uncertainty to when the full in-person return will happen. Still, when it does, you can expect to see tough competition for workers as recovering sectors seek to pull workers back from other areas of the AV industry and from other industries entirely.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.