Pro AV Ball Is Rolling in 2024

A positive shift away from significant challenges could indicate a healthy year for integrators.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

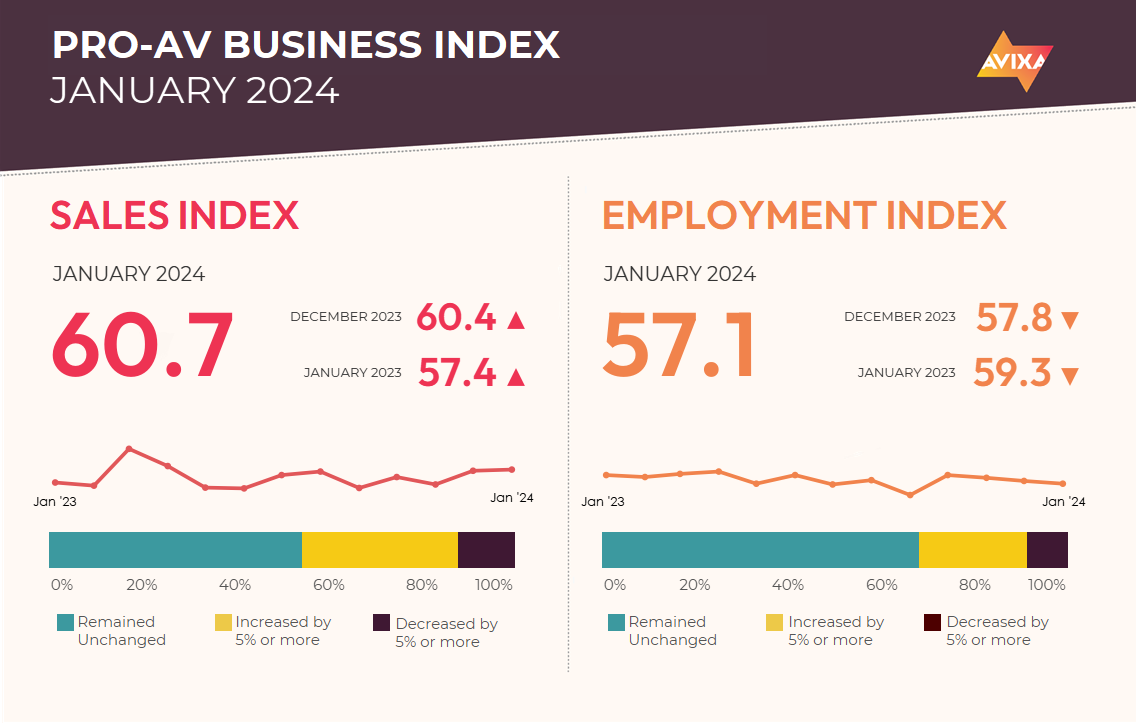

While 2023 was a steady, unspectacular year that saw the AV Sales Index (AVI-S) average 58.8, 2024 is off to a better start, with the January AVI-S measuring 60.7. This is almost exactly the level the AVI-S averaged back in 2017 (60.6). While 60.7 is still not a spectacular level, it’s also a positive one and hopefully a harbinger of a healthier 2024 for our industry.

On a micro level, comments from survey respondents show that the new year looks a bit like the old year. Long-standing issues of supply and labor force continue to be a thorn in the side of many businesses—though we stress that things are much better than at this time last year. Improvement in supply also translates to positivity in the index. For some companies, the reason their company saw improved sales is getting in the equipment needed to finalize and bill for certain projects.

[AVIXA Foundation Announces the Brad Sousa Impact Fund]

While some data suggests continuity between 2023 and 2024, our data on the top issues for Pro AV show several positive shifts. Since September 2022, we have asked respondents to identify their most significant business challenge over the last month. January was the first month where “We have not had any significant challenges” was the top response (18%).

A second noteworthy shift was in “Rising costs/inflation.” Over the life of the index, this issue has ranged in mid to high in the rankings, reliably below “Supply issues” but often near other high-ranking categories such as “Hiring/retention” and “Recession/business cycle.” But in a sign of the turning times, it was by far the lowest of our major categories at 8% in January. The next lowest was “Supply issues” at 12%.

Times have changed in Pro AV. And that change is likely to continue. We strongly expect these categories to continue to fall throughout 2024.

[ISE 2024: 3 Trends That Will Extend to InfoComm 2024]

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

The AV Employment Index (AVI-E) is off to a modestly less positive start than the AVI-S. At 57.1, this January reading is roughly in line with the 57.8 observed in December. However, this marks the third consecutive month with a sub-one-point change, but the trend is downward since all changes have been negative. In addition, the 57.1 observed in January is below the 2023 average level of 58.2. That said, as covered previously, 2023 AVI-E numbers were higher than expected based on in-period sales growth since companies were still boosting staffing levels to catch up with the 2022 revenue boom.

With that context, it’s unsurprising to see the current AVI-E level. Going forward, if the AVI-S can maintain its level of around 60 or 61, we would expect the AVI-E to increase to 58 or 59.

In the wider economy, the news is better. U.S. employment data for January again showed surprising robustness, with 353,000 jobs added alongside a 4.5% increase in average wage (well above inflation). This is a strong indicator of U.S. economic health and should support confidence that recession is unlikely.

[AVIXA Report: Solid Close to Solid (but Complex) Year]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.