AVIXA Report: Strength of Pro AV Sales Surprises

Industry growth remains strong, but survey respondents expressed concerns regarding product lead times and labor market difficulties.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

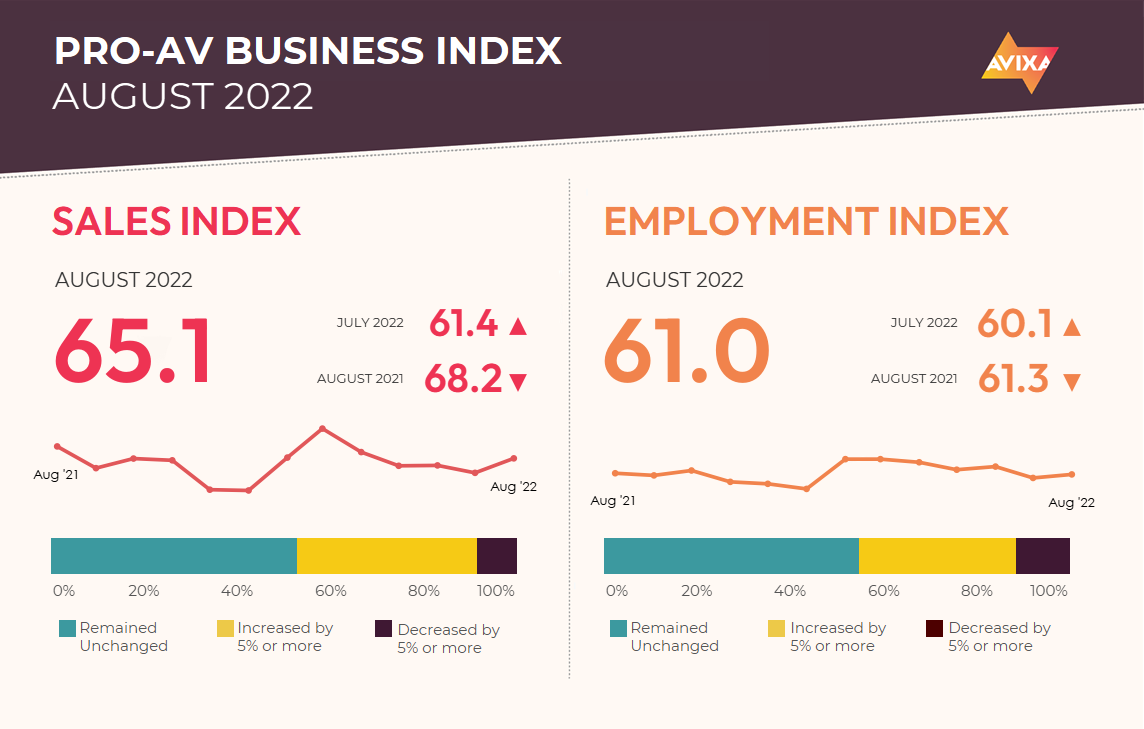

Perhaps the tailwind of return to in-person hasn’t fully spent itself yet. Despite continued general economic threats and weakness, AVIXA’s latest Pro AV Business Index shows August was an exceptionally strong month for AV sales growth. The AV Sales Index (AVI-S) accelerated from its July mark of 61.4 up to 65.1, the highest mark since April.

Despite the positive overall, survey comments skewed negatively. While this may seem contradictory, AVIXA analysts believe it reflects the salience of the current challenges. For example, supply issues see certain products with lead times of more than a year. One commenter wondered if any digital microphones were left on Earth—and if perhaps they need to search farther afield into the galaxy. Labor market difficulties were acute as well.

“The sheer unusualness and sharpness of these issues spur comments, even if overall sales are growing,” said Peter Hansen, economist, AVIXA. “Going forward, the AVI-S will likely decelerate from its current mark. Given the string of scores in the low 60s and the lack of a clear, enduring reason for the acceleration, it is unlikely the 65.1 score represents a new normal.”

[Open for (Immersive) Business]

Recession threat is a persistent concern. In China, the central bank very slightly lowered interest rates in response to fears of contraction. In Europe, fears center on a realistic scenario where spiking winter fuel costs due to sanctions and retaliation from Russia cause a downturn. And in the United States, the Federal Reserve’s restated commitment to combating inflation by applying the brakes to economic growth creates a serious risk of recession. In sum, that’s a great deal of risk.

For data on what a recession might mean for Pro AV and how companies can prepare, take a look through AVIXA’s library of quarterly Macroeconomic Trends Analysis (META) reports at www.avixa.org/META (free to Silver and Gold AVIXA members). The “Recession Impacts” report looks at the scale of contraction of Pro AV during a recession, and the “Recession Roadmap” report reviews vertical market performance during the Great Recession of 2008-09 to assess which areas provide the most secure revenue sources.

The AV Employment Index (AVI-E) also ticked up in August, though less dramatically than the AVI-S. The current figure is 61.0, up just less than a point from the July mark of 60.1. For Pro AV, this signals continued labor market challenges. Hiring will not get easier, and nor will retention. Businesses experiencing the kind of sales growth shown in the AVI-S should budget extra time and money to find and retain the talent needed to support the project work.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

[Supply Chain Issues: Here's How Crestron Is Handling Them]

In the wider economy, U.S. employment numbers for August showed more strong growth with 315,000 new jobs. The unemployment rate did tick up 1/10 of a percentage point as more workers entered the labor force—a small relief to businesses straining to find help.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.