AVIXA Report: Have We Stuck the Soft Landing?

Pro AV is getting stronger as the overall economy celebrates a run of positive news.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Good news, good news, and good news this month! Conditions aren’t perfect, but the macroeconomy has hit a strong run of good news, and Pro AV seems to be strengthening along with it.

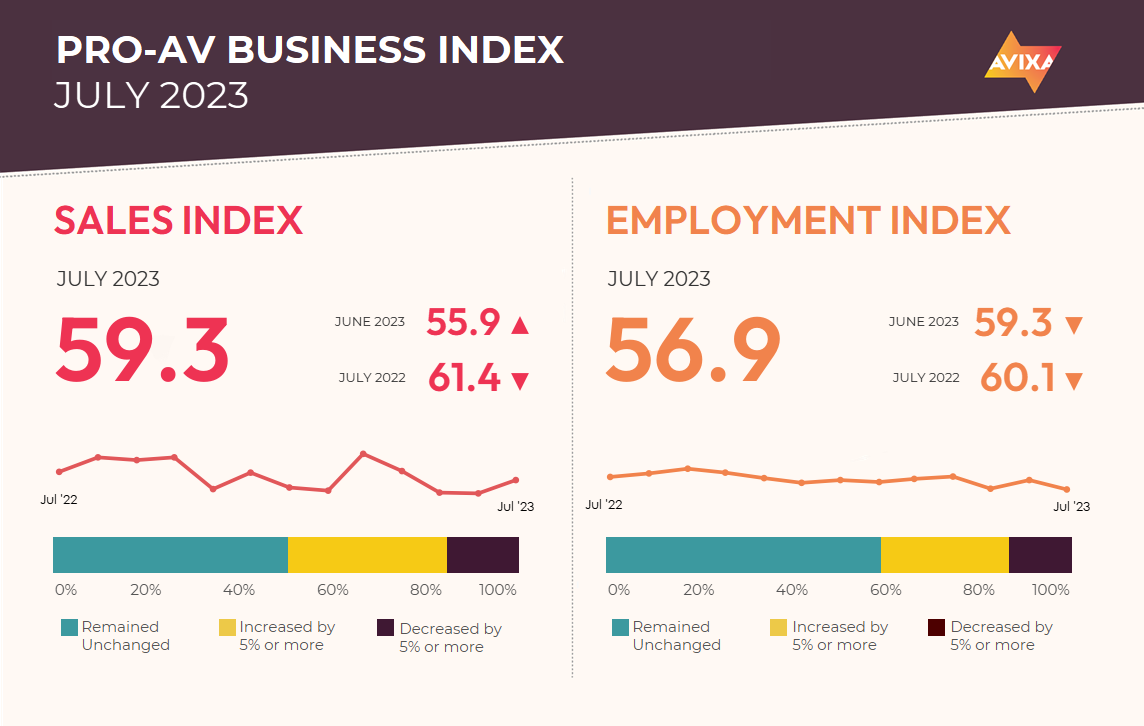

Starting with Pro AV: Our sales index for July shows an acceleration in revenue growth, from the positive but mediocre June mark of 55.9 to a solid but unspectacular mark of 59.3 for July. In describing company performance, survey respondents highlighted a variety of factors. Positive influence from the economy was common, though others highlighted ongoing economic challenges.

Supply chains remained a frequent factor, though the consensus and our data are clear that they are on a trajectory of improvement. Hiring is also an issue; while some companies are fine, others remain perpetually understaffed or struggle mightily to fill open positions.

[AVIXA Report: June Sales Growth Steady, Payroll Growth Stronger]

The best news came from the wider economy this July. U.S. GDP hit a big surprise when the advance estimate of second-quarter growth came in at an annualized rate of 2.4%. So much for the first-half recession concerns.

This good news on growth was accompanied by good news on U.S. inflation, which saw the annual CPI inflation rate cool to just 3.0% year-on-year (down from 4.0%). Core inflation, which is an important guide for interest rate decisions, was higher at 4.8%, though this, too, was a meaningful improvement from the May mark of 5.3%.

These major pieces of good news contributed to a special outcome in the Dow Jones stock index: a 13-day winning streak, the longest in 36 years. In fact, the streak was just a day short of the all-time record set back in 1897. It’s not all good news—Europe continues to experience stagnant growth, though inflation is declining there, too.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

The AV Employment Index (AVI-E) wasn’t as positive as the rest of the report this month, falling from 59.3 to 56.9. Now, 56.9 is not a bad result for the steadier AVI-E, but it is the lowest level recorded since July 2021.

Interestingly, the result paralleled the data on U.S. employment for July, which showed the addition of 187,000 jobs, a level that was the lowest since 2020. Yet, the news was good overall. To start, 187,000 jobs would have been a bit above average for the months leading up to the pandemic. Beyond that, unemployment ticked down to 3.5%, and the average hourly wage increased at a 4.4% annualized rate. In sum, a positive report, even if hiring is slowing down—for Pro AV and the U.S. economy alike.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.