AVIXA: AV Sales Growth Remains Strong Despite Rising Delta Wave

July was another good month for the pro AV industry, according to AVIXA’s latest Pro AV Business Index. The AV Sales Index (AVI-S) scored its second-highest figure since the start of the pandemic in a modest deceleration from June’s high.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

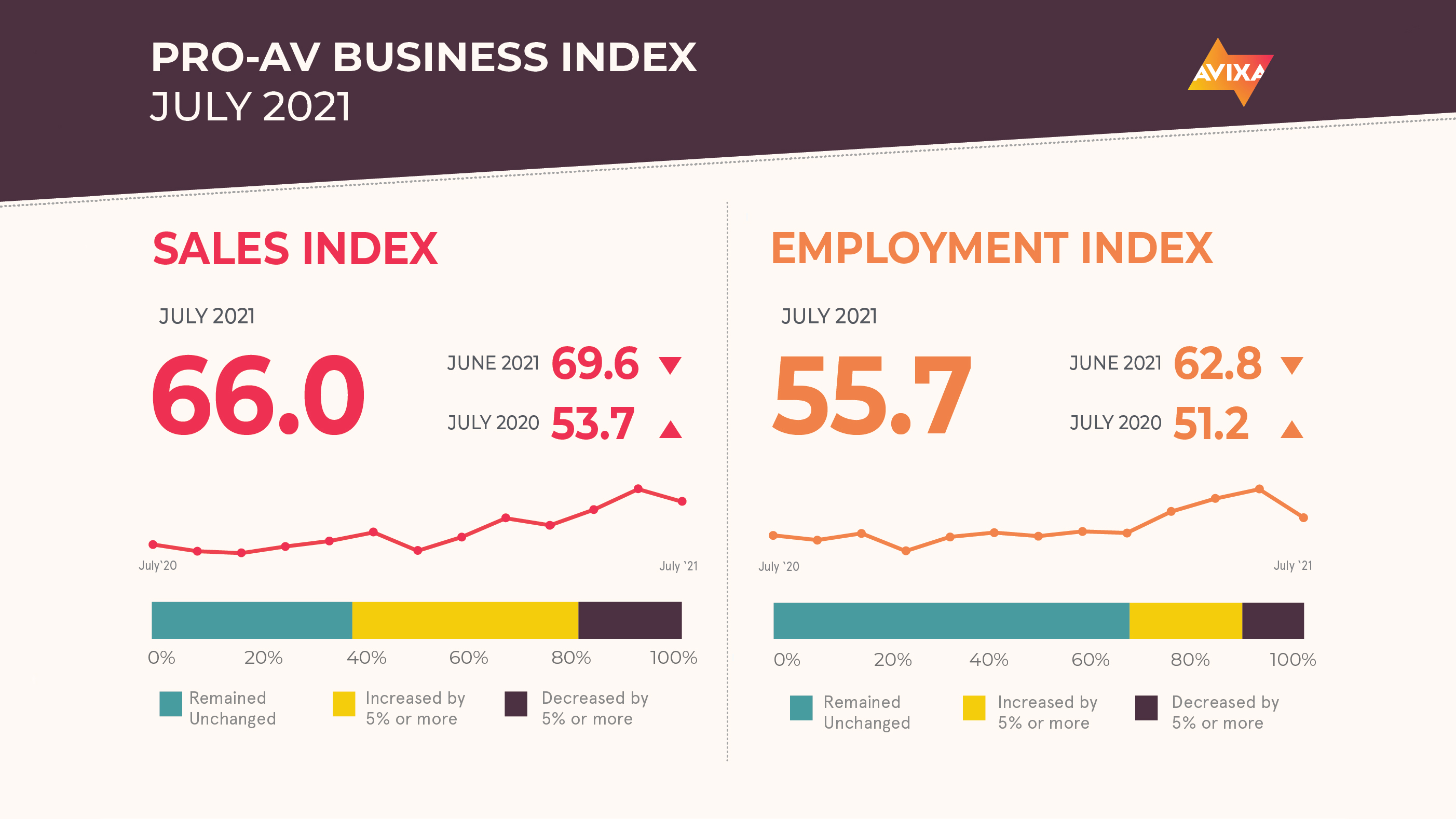

AVIXA’s latest Pro AV Business Index shows July marked another good month for the pro AV industry. The AV Sales Index (AVI-S) scored its second-highest figure since the start of the pandemic. At 66.0, the reading was a modest deceleration from the June mark of 69.6, but it was still comfortably ahead of any other mark set since the pandemic. In fact, this was the second-fastest growth month since 2018.

Growth may have been slower than in June, but it was still very rapid. There were two clear business challenges in July: the rise of the COVID-19 delta variant and supply difficulties. With the delta variant, commenters pointed to its delaying effects on the return of live events and return to office. Supply was more of a “good” problem in that it was a challenge for companies that were experiencing high demand. Still, it is a barrier to growth as work proceeds more slowly and companies are sometimes forced to turn down work.

“From our data, COVID-19 looks like the bigger reason for slower (though still fast) growth in July,” said Peter Hansen, economic analyst, AVIXA. “We just completed a deep dive into supply issues for a third quarter Macroeconomic Trends Analysis report, and a few lessons there are clear: one, supply issues are longer term, so not affecting July too much more than June. Two, pro AV companies are managing supply issues well. Some projects are slower, and some prices are up, but as we show in the report, there are lots of effective ways to grow revenue despite the difficulties.”

[ June 2021 AVIXA Pro AV Index: AV Sales Growth Soars to Near Record High ]

Second-quarter GDP in the U.S. was a mixed bag. At 6.5 percent annualized growth from the first quarter, the growth was strong and lifted the GDP level above its pre-pandemic high. But this figure was below expectations, which hovered close to 8.5 percent. We note that, due to its concentration in in-person industries, pro AV spending remains below pre-pandemic highs; for more detail, check out AVIXA’s latest edition of the Industry Outlook and Trends Analysis (IOTA) report series.

Other major economic areas are at different points in their recoveries. In the EU, second-quarter GDP grew at a similar rate to the U.S. (6.1 percent annualized growth from the first quarter), but its level remains below its pre-pandemic highs. China grew at the lowest rate (5.3 percent), but it stands out in that its GDP is already far beyond its pre-pandemic highs. When compared to the U.S. and the EU, the growth China is seeing is reflective of long-term trends rather than short-term recovery. In other words, though the growth was slower, it is also closer to expectations of long-term growth rates. For pro AV companies, China remains an excellent area to capitalize on economic growth.

The AV employment index (AVI-E) was the disappointing note in this report. While payrolls continued to expand in July, they did so at a rate lower than in June, as the AVI-E subsided from 62.8 to 55.7. This comes as something of a surprise since sales growth remained so strong and changes in employment trends tend to lag behind trends in sales. With that in mind, AVIXA analysts predict that the July result was something of an outlier and that despite the newly rising case counts, the AVI-E in August will be similar or better than July. Another reason for AVIXA’s confidence that the comparatively low AVI-E was noise rather than signal is the overall U.S. employment, which recorded a gangbusters 943,000 new jobs and saw the unemployment rate drop from 5.9 percent to 5.4 percent. Added to this was a 0.4 percent increase in average hourly earnings, which computes to an annual rate of 4.9 percent. Altogether it’s a remarkably strong report, and there’s no reason for pro AV to be an exception. With that in mind, AVIXA analysts are confident the slower July growth is a blip rather than a trend.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Click here to read more stories from the September 2021 issue of SCN.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.