Supply Chain Economics - Coping With Changes in Manufacturing

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

“Manufacturing costs for production will likely be near parity between China and the U.S. within the next five to seven years.” —Steve Young, Atlas Sound

When Mick Jagger insisted that “time is on my side,” he probably wasn’t referring to time crunches in AV supply chains.

As AV manufacturers and integrators face delays in overseas shipments, and deal with production challenges and rising costs, new strategies are needed to navigate the murky supply-chain waters.

“Government mandated wage increases have been instituted in China of 10-percent per year for the next five years and most of our sources there are passing these increases straight through to us,” said Steve Young, vice president of sales and marketing at Atlas Sound. “Manufacturing costs for production, including metal stamping, injection molding, and small-volume electronic assembly will likely be near parity between China and the U.S. within the next five to seven years.”

Neodymium shortages and the resulting price increases (exceeding 150 percent in some cases) have affected all speaker manufacturers who use compression drivers, he added. “We build a lot of vehicular warning products, including police sirens, that use Neo, and it was brutal. Neodymium comes mostly from China and Australia, so we have little control over raw material costs. As a result, we are migrating research and development of new products toward solutions that utilize Alnico and other magnet types. For magnets used in traditional cone speakers, there are also challenges because magnet manufacturing in the U.S. is basically nonexistent, driven offshore in past years as a result of EPA restrictions and price pressures.”

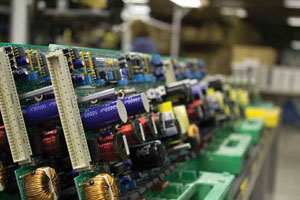

Despite this, Atlas is generally coping well as it has always maintained a fair balance of domestic and imported product. “We still do a lot of metal work (racks, cabinets, speaker enclosures) in our Ennis, TX plant near Dallas,” said Young

As AV manufacturers and integrators face delays in overseas shipments, and deal with production challenges and rising costs, new strategies are needed to navigate the murky supplychain waters.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

According to Young, Atlas Sound parent company Mitek Communications and Electronics Group CEO Loyd Ivey insists that the company keeps domestic source contacts, and carefully examines every project to determine the best path for production. “As of late, more of our products, specifically surface-mount electronics, are produced in our Phoenix, AZ factory. Much like Monroe, WI, we used to build 250,000 car audio amplifiers there, but now we produce high-quality IED, Varizone, and Atlas electronics that are shipped worldwide.”

Just-in-time (JIT) inventory is a concern for both manufacturers and resellers, he said. “With production in Asia, long lead times are an inescapable reality of 12 to 20 weeks in most cases. Even if there is a slightly higher domestic cost, we can build in smaller quantities. Often this makes better monetary sense than being financially committed for container quantities with long lead times.”

Lowell Manufacturing is very fortunate to be able to manufacture more than 95 percent of its products in the U.S., using domestic components whenever possible, said Deborah Scantlin, purchasing manager. “For those products that could be affected by changes in offshore supply chains, we increase order quantities and keep safety stock on hand to avoid shortages. Lead times for components are lengthening so we closely monitor any orders we place with offshore suppliers. We also try to maintain close relationships with them so we can work together to solve problems as they come up.”

For integrators, forecasting tools are among the best defense against supply glitches. “We are doing our best to use forecasting tools and also to keep an eye on high run-rate item orders when ordering from our key vendors,” explained Patrick G. Hannon, director of procurement at AVI -SPL. “We feel like we have a very strong pulse on the potential closed projects, and have very good communication with our key strategic partners so that we can plan ahead enough to minimize/ eliminate the impact of delayed shipments.”

At Whitlock, processes are in place for addressing slowdowns in its supply chain. “As an integrator, managing equipment specifications and lead times are obviously one of the most crucial ingredients of successful project management,” said COO Roger Patrick. “Our business model is not designed solely around the speed of processing large volumes of equipment from the manufacturer directly to the consumer. Our typical client engagements involve longer lead times, prefabrication, staging, and custom solutions, which help to shield us from the negative impacts from manufacturing delays.”

To help mitigate any risks, Whitlock has implemented a higher level of proactive project management, working closely with procurement and customer service to identify earlier in the process those products that might disrupt timelines. “This is opposed to us previously being able to rely on setting general guidelines and worst-case scenarios for product delivery of maybe four weeks, assuming it did not include custom fabrication of some kind,” he said. “This also has forced us to be more proactive in implementing follow-ups with manufacturers early on, and not to take quoted lead times as the gospel. We are fortunate to have acceptable alternates in most cases that can be identified and approved with little to no impact on project schedules.”

Early communication across the organization is also more important than ever, Patrick added. “The adoption and dedication to our intranet for blasting updates daily regarding potential delays has helped Whitlock be proactive and set early expectations.”

Then and Now

Today’s cost dynamic is entirely different compared to that of recent years. “My advice is to partner with a vendor who is well capitalized and willing to work with customers to determine forecasts,” Young said. “At Atlas, we have over 1,100 SKU s, including 400 highvelocity ones, our A list. Those are inventoried at much higher numbers than typical safety stock, and used every day. For the last year and a half, we’ve had about 98-percent availability of items on that list. We track that benchmark very carefully, and our customers seem to appreciate it.”

Despite the current challenges created by natural disasters overseas, products are generally more readily available and there are many more options to meet the desired specifications, Patrick said. “This makes it a buyer’s market in general, one that is forcing manufacturers to offer much more to the consumer in terms of functionality, availability, and warranty with so many options available.”

Atlas Sound has always maintained a fair balance of domestic and imported product.

The result is that prices are being forced down. “How that pertains to an integrator is that we have to be more proactive in managing the procurement cycles, with the reality that consumers expect the same instant gratification and delivery of our products as they do walking into a retail store,” he added. “Nobody wants to order anything anymore and hear that they have to wait for this or that product because it is worth it. So you have to prove the unique value or quickly move on to an alternative and have your organization prepared to deal with that dynamic.”

And as prices and margins have become more competitive, manufacturers have increased warranties and functionality, but also have tightened up return polices and restocking in general. “As a custom system integrator, where our only inventory should consist of WIP or overstock/mistakes from past design errors, we do not have the ability to take risks and extend restocking policies that do not directly match those of our manufacturers,” Patrick said. “This is especially true today with decreased margins and the fact that technology is moving at a rapid pace, creating new model numbers and making it hard to move overstock. We really have to tighten up the sales process, and scope sign off and commitment from the clients regarding procuring custom equipment lists for their project/facility.”

Additionally, for those unavoidable times in which Whitlock has to extend a return to a client that is not accepted by its manufacturing partner, they must deal with the turnaround of that equipment much more diligently before it becomes antiquated or drops drastically in value.

“As an integrator with multiple locations, we have implemented stronger controls for identifying overstock earlier and making it readily available to all locations at the appropriate current value,” he said. “We cannot afford the days where integrators waited until a project was signed off to figure out what was left and then how to value and move that gear.”

Brave New World

To survive the range of possible delivery challenges, maintaining strong relationships with your key partners is imperative, explained Hannon. “When you are in a tight situation, you have to have strong forecasting and good relationships with your key vendors so that they can help you when timing becomes critical to deliver to your customers. It is also important to always have a pulse on your high run-rate items and make sure you are ahead of the curve when ordering these items so that you can avoid the timecrunch issues.”

Integrators need to look to fewer partners, stronger leverage, more proactive CRM forecasting, and a much stronger project management process, Patrick said. “Traditionally, project management has been viewed as something that starts after we receive an order, and in some cases, even much later than that, after final drawings, a kickoff meeting, or some other event that forces it to become a priority.”

Product selection and the evaluation of alternatives should be moved to a very early spot in the design process, he advised, as integration into clients’ schedules and the outlining of plans to meet those schedules are crucial to both successful award and performance on large and high profile projects today. “Defining risks, such as product availability, is a key and more formal part of our project management methodology.”

In Atlas’s recent acquisition of A-Line Acoustics, there was no consideration to build offshore. “We retained people who ran the shop and moved production to our multifab facility in Monroe, WI,” Young said. “At one time, we (Mitek/MTX) produced thousands of mobile subwoofer enclosures in this plant. But even with the most efficient automation and robotics, downward price pressures forced us to move production of these products to China over the last five years. However, a premium loudspeaker line like A-Line demands short lead times, smaller run quantities, and opportunity for customization that would simply not be an option if the product was manufactured in Asia. We are excited to bring our Wisconsin factory back online, staffed by the local Swiss craftsmen who take exceptional pride in their work. Expect to see many of these great products at InfoComm.”

Karen Mitchell is a freelance writer living in Boulder, CO.

Six Tips For Managing On-Time Equipment Arrival

Steve Young, Atlas Sound

- * As a manufacturer, never forget to factor in delays caused by the Chinese New Year.

- * Forecast early and forecast often.

Roger Patrick, Whitlock

* View project management as starting during the design phase.

* Have your project manager in operations more involved in proposals and opportunities early on to define risk, as opposed to waiting until you are awarded a project.

Patrick G. Hannon, AVI-SPL

* Make certain to do efficient ordering.

* Remember that the relationships you build with your partners are key; these partners will be your best friends in time of need.

What’s Ahead?

Continued high demand will call for even better, more efficient planning. “There is a critical game that must be played to maintain low risk on your capital outlay while satisfying your customers with on-time delivery,” said AVI-SPL’s Patrick Hannon. “We face it on a daily basis, and the balance of the two is a major factor to the success of your procurement department.”

Expect more of the same in the future, Whitlock’s Roger Patrick cautioned. “We have to tighten up procurement processes and become much more of a machine. As margins go down, procurement processes and the associated costs have to become streamlined and more efficient.”

Contracts and purchase agreements will have to be more rigid, scopes tighter, and account executives and project managers trained to set proper expectations with clients. “In general, AV systems integrators’ procurement and quality control processes have been behind that of other closely related technology industries,” he said.

Like so many other trends from IT, from project management to professional services, integrators have to follow the model of large IT and other systems integrators with procurement practices.

“Whitlock’s strategy of focusing on services and becoming less reliant on equipment margins for more than 15 years has helped us grow as equipment values and margins have declined. However, we have to continue to focus on ensuring our services become increasingly more valuable and repeatable. As that occurs, there will be more opportunity for moving large volumes of equipment,” Patrick added. “However, our enterprise clients’ expectations are for that to be handled at a very competitive margin and with very high levels of quality control.”

—K.M.