Discovering Where Your Target Customers Buy

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

- Examine any issue of this magazine and you will see an article about a project that you should have done. What made that customer choose that Stager? Why won't that producer return my phone calls? Even more frustrating than unreturned inquiries is that oftentimes the featured project is way outside your perception of that Stager's capabilities. Most folks just shrug their shoulders and say, "Must be a relationship thing." The implication is that some special bond exists between the customer and someone within the staging company that supercedes capabilities. If that helps you sleep at night, go ahead and believe it. What I am seeing more and more is that certain staging companies understand better than others the market channels that lead to these gem shows.

- Marketing is generally the last thing Stagers think about. The typical life cycle of a new staging company follows this pattern: The company starts business with one or two key clients already secured and the gear and people to support those projects. In between those gigs, everything is fair game. Box rentals, breakouts, simple setups, courtrooms, and even simple installations all generate cash flow and keep the business afloat. A few more years down the road and the once successful start-up is now stuck in what I call the Stager Doldrums -- two to four million dollars in revenue and a reputation as a solid medium-to-small-show operation that also has a couple of big shows a year.

- Breaking out of the Stager Doldrums is a major test of company vision, but a lot of practical things have to first come together -- the right technical personnel, leading-edge project management, serious technology investment, excellent cost controls, a great sales team -- to name a few. If your company self-image matches up with what your customers or prospects see in you, AND if you can get that marketing message out to even more potential customers, then you have what it takes to break away. There are many companies that almost get to this point, but the final hang-up is marketing. And the first question of marketing is "Who are your potential customers?"

- To answer that question, Stagers need to know about Market Channels -- the line of individuals and organizations responsible for moving goods and services to the end customer. Market Channels are not always apparent when the Stager has a direct relationship with a corporate client -- the bread and butter of small to medium stagers. However, without an understanding of how the market might one day influence that affiliation, the Stager risks losing that customer to more sophisticated business relationships -- which leads to the second thing stagers need to know: Every job or opportunity either has an established channel or is waiting for the right one to appear.

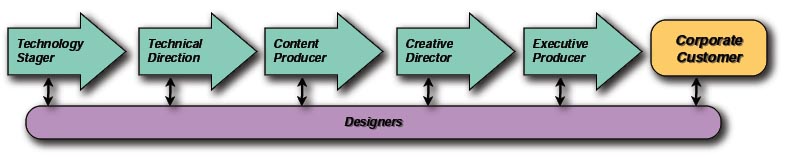

- For instance, many well-known events are sold through the traditional producer channel (Figure 1). The end customer hires a producer that sub-contracts design and technical direction that in turn hires staging services.

- Figure 1

- Note that the design contribution can be introduced at almost any relationship level. Designers (and guest engineers) in general can have a lot of influence over vendor selection and are therefore your customer -- even though they will never write you a check. Stagers that seek to control the design element when a Designer is involved, will quickly find themselves out of the running for that project. In short, the Stager doesn't have the direct relationship with the corporate customer.

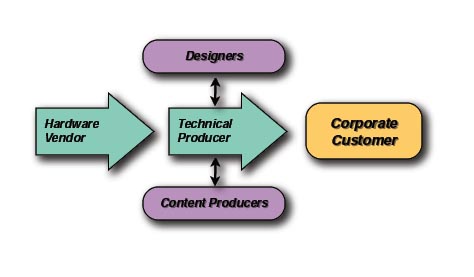

- The model more commonly found in entertainment and the largest of corporate events is less linear (Figure 2). Collaboration and strategic relationships between companies in the market channel is very normal here. The key player is the Technical Producer, which often consists of the hardware vendor and its affiliates or subsidiaries. The risk (and profit) rests in the production, which is managed by the technical production company. The Creative Director may be an additional player in that they have a semi-permanent relationship with the end customer, but they can also be found working for the Technical Producer. And Designers also like to collaborate with Technical Producers because it can lead to more work and referrals. If this looks familiar, it may be because this is a traditional agency model used in advertising. Technical Producer is the position most often sought by Stagers today.

- Figure 2

- The marketing challenge for Stagers is to look like you not only belong in your chosen market channel(s), but that your channel customer can see themselves doing business with you. If the above channel depictions do not look familiar to you, do not despair. That simply means that up to now, your relationship with key customers has not been heavily influenced by outside forces. That time is coming, and even the best of customers will one day entertain another vendor. If that supplier looks like your company, then the comparison is fairly easy. However, if your competition introduces one of these market channels to your client, and if that channel makes more sense for the project -- your relationship will be at risk.

- So the question ultimately becomes -- do you sell to the end customer or to someone within the channel? Conventional wisdom says that you have to pick, because if you choose to sell to the end customer you will be in direct competition with the production channel. This is where the vision thing kicks in. There are some large and very successful stagers unapologetically selling in both channels plus maintaining direct relationships. There are even more mid-sized regional stagers who have balanced producer and end client business quite successfully for years (see R&SS, April 2007 "Are AV Producers Part of Your Future?"). What all of these successful companies have in common is a clear understanding of how the market works and what their company has to offer. In other words, knowing all the reasons of why something can't work, they figured out why it could.

Branding at Work

By Tom Stimson, CTS

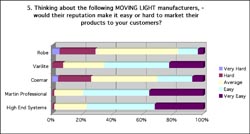

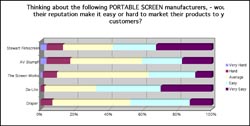

In this months Market Snapshot survey, The Stimson Group asked Rental & Staging professionals about whether the reputation of various manufacturers helped or hurt when marketing those products to the stagers customers. While the results are not very surprising in todays context, it was not that long ago that some of the most highly rated manufacturers were struggling for respect in certain product categories.A good example of this is in lighting technology. In the late 1990s Martin Professional was the hottest lighting manufacturer in Europe, but legal hassles kept some of their best products out of North America. As a result they had a reputation as a club lighting brand. Today 82 percent of stagers surveyed rate the brand as easy or very easy to market to end customers.

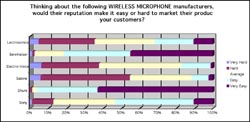

The wireless microphone category has a similar story. Ten years ago, Sony and Sennheiser owned the live event market for their dependability. Shure was saddled with a pro AV label and had almost no entertainment credentials. (Entertainment riders often listed Shure as not acceptable for wireless applications). Today, the Shure name is at the top of everyones list with 98 percent of respondents rating them as easy to very easy to market.

Of course, brand names and reputations are not the same as performance and quality as cutting edge manufacturers like Lectrosonics will point out. What may be a top name in one segment might be relatively unknown in another. Stagers who try to use their choice of manufacturers as a competitive advantage rely heavily on those manufacturers to create great brand reputations. It would appear that some companies have their work cut out for them.

Download the complete October07 Survey including results on six manufacturing categories at: www.trstimson.com.

Each month The Stimson Group conducts a short survey of AV industry professionals about a variety of topics. To participate in or comment on those surveys, email: surveys@trstimson.com.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.