Pro AV Sales Miss Expectations in Latest AVIXA Pro AV Business Index

In AVIXA’s latest Pro AV Business Index, pro AV sales growth underperformed expectations. Survey respondents highlighted a number of challenges, with the pandemic and supply chain issues among the most common.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

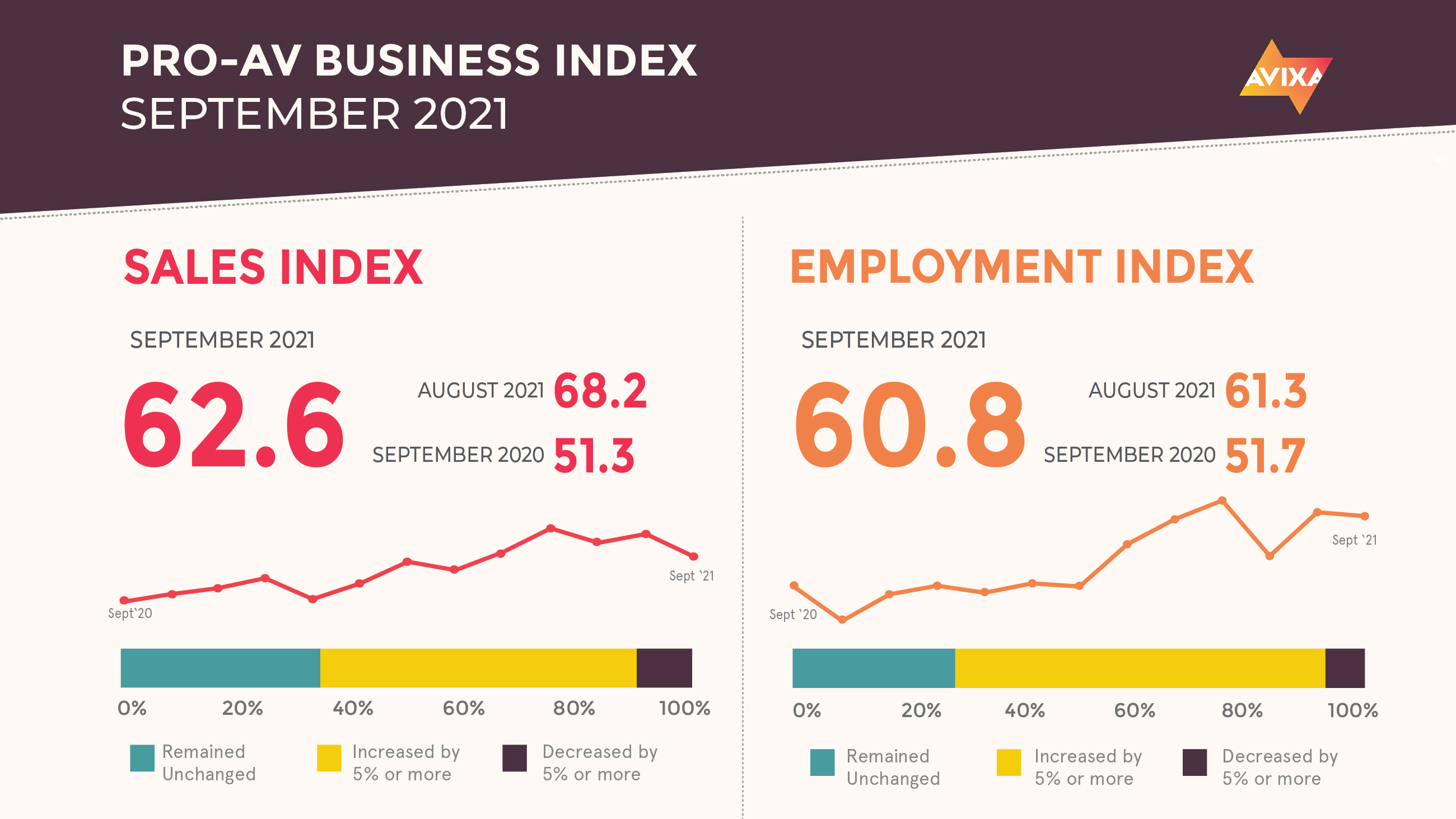

In AVIXA’s latest Pro AV Business Index, pro AV sales growth underperformed expectations. The AV sales index (AVI-S) came in at 62.6 for September, a drop from 68.2 in August. The survey respondents highlighted a number of challenges, with the pandemic and supply chain issues among the most frequent, along with many forms of uncertainty.

The story was not all negative, though. Respondents observed positive trends in return to live events, preparation of offices, and other sources of AV spending. And while the results mark a slowdown from August, the September 62.6 AVI-S is still high relative to most of the index’s history. For example, in 2019, only two months saw faster growth rates. Going forward, AVIXA analysts are confident that the index will show accelerating sales growth, with a higher AVI-S likely in October.

Supply chain challenges have not eased, as issues such as a weeklong Malaysian chip factory closure due to a COVID-19 outbreak continue to disrupt global supply lines. It is as important as ever to monitor your supply lines, including tier 2 and tier 3 suppliers if possible. COVID-19 continues to pose closure risks to factories and ports around the world, most especially in Southeast Asia. If your monitoring can help you identify a problem before your competitors, your company will have the easiest time adjusting.

“Now more than ever, businesses should be seeking to quantify the reliability of their supply chains,” said Peter Hansen, economic analyst, AVIXA. “How are you measuring the biggest associated risks? How are you measuring its resiliency? How is that resiliency changing over time? Supply chain issues are going to get better over time, but not overnight. Careful and accurate monitoring will remain vital for months to come.”

AV payrolls continued to grow steadily, as the AV employment index (AVI-E) measured 60.8 in September, right in line with the August mark of 61.3. Employment growth has not hit the same highs as sales growth yet; while the June-August period marked the fastest growth in AVI-S history, the AVI-E remains in more normal territory. AVIXA analysts see this as a predictable result based on their major annual employment research project. In that study, workers revealed that they were less busy than in prior years, indicating that our industry had extra capacity already on payroll. Record high growth rates remain a real possibility but are unlikely this year.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

This article originally appeared in the November 2021 issue of SCN. Click here to read more stories from November 2021.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.