Positive December Closes Strong but Inconsistent Year for Pro AV

After a disappointing November, improved numbers helped raise the AV Sales Index to tie its highest annual average.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

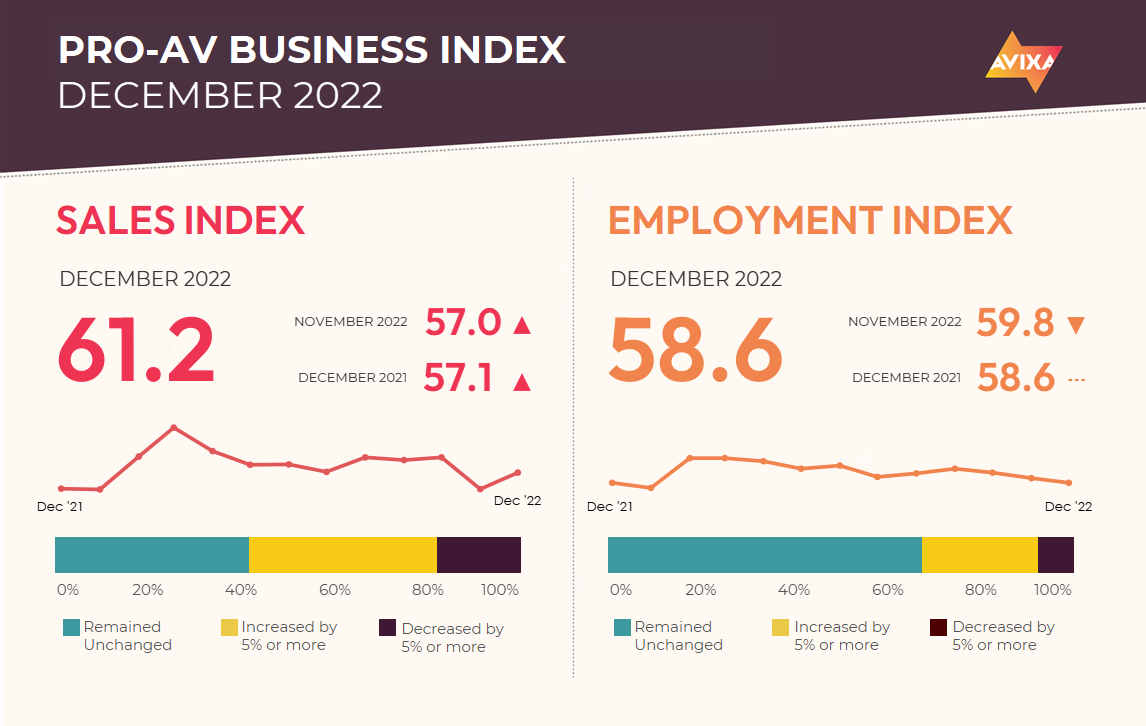

The AV Sales Index (AVI-S) rebounded from a disappointing 57.0 in November to 61.2 in December, closing out 2022 on a positive note. (Note, the December numbers come from a larger sample size, as AVIXA polled approximately 300 additional AV professionals from the ISE mailing list in preparation for ISE 2023 at the end of the month.) In the end, 2022 tied 2018 for the highest average index, at 63.5.

That said, the two years arrived at the same number in different ways. 2018 saw a peak of 67.4 and a minimum of 58.0, a range of 9.4. It was a consistently good year. In contrast, 2022 had a lower minimum at 56.9 in January and a much higher max at 72.7—the all-time record high—in March, for a range of 15.8. It was an inconsistent year, but also a good one.

Each December, we also ask the same sales index question—greater than 5% increase, greater than 5% decrease, or about the same—but we focus on year-to-year change rather than month-to-month. For 2022, this question netted an annual sales change index of 72.5. This was up 4.6 points from the 67.9 recorded for 2021 and up 41.0 points from the 31.5 recorded for 2020 when the majority of businesses saw greater than 5% revenue decline.

It’s important to note that this outstanding 2022 growth happened despite major supply challenges. Despite alarmism from some corners, these issues, though a major headache for our industry, were a brake rather than a block to growth. With perfect supply, Pro AV revenue would have spiked faster and run much worse staffing issues than we did. The net is with a strong 2022 that starts 2023 with holdover demand due to unfinished projects.

While 2022 may have tied for record average monthly AVI-S, the AV Employment Index (AVI-E) set the record outright. The 2022 average was 61.6, ahead of 2018’s previous record of 60.9. In December, the AVI-E was 58.6.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

Here is a major contrast in our indexes: Where the 2022 AVI-S range was 15.8, the AVI-E range was less than half, at 7.6. Oddly, the min and max happened in back-to-back months—January and February—when the Omicron COVID-19 variant suddenly spiked then quickly faded, ushering in the record year we ultimately observed.

Payroll growth was an economy-wide phenomenon in 2022. The U.S. economy added 4.5 million workers, and many other countries also experienced strong payroll growth. Less exciting is the trend in these expansions, which for Pro AV and the wider economy alike is toward slower growth. But at least at an economy-wide level, the observed 2022 growth was unsustainable. If the United States ends 2023 with 2 million new jobs, it would be fair to argue it was a great year that saw the pandemic recovery stabilize onto a growth course our economy can keep up for the long term.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.