AVIXA Report: Record Growth as Pro AV Shrugs Off Supply Difficulties

People are rejoining the labor force—and companies are adding them as fast as possible.

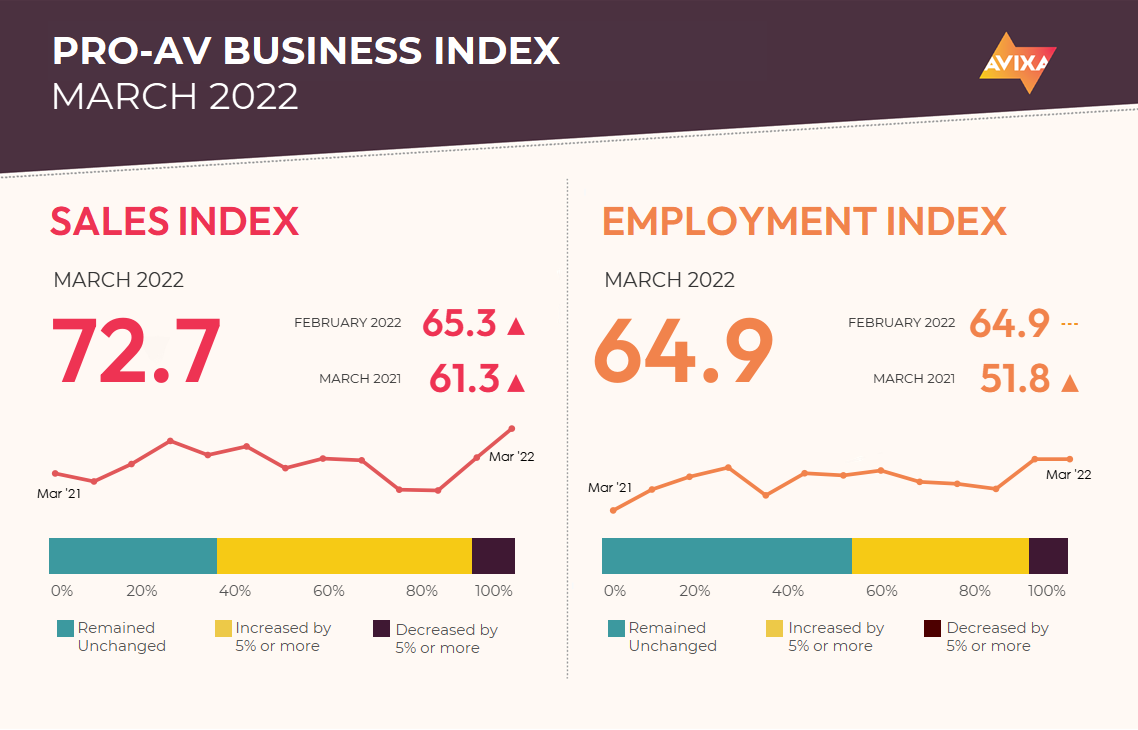

With as many supply challenges as the Pro AV industry is facing—91% of respondents to AVIXA’s latest Pro AV Business Index report facing at least some supply delays—growth in AV sales reached a record in March. The AV Sales Index (AVI-S) measured 72.7, up 7.4 points from February, up 3.1 points from the pandemic recovery record of 69.6 (in June 2021), and up 1.1 points from the all-time record of 71.6 (in March 2017).

[Risk Mitigation Strategies for Evaluating New AV Products During Supply Chain Issues, or Anytime]

“Driving the record is the recovery from the pandemic, especially with many countries sunsetting restrictions and moving towards an endemic COVID-19 approach,” said Peter Hansen, economist for AVIXA. “Commenters in our survey are clear, though, that growth faces its own restrictions, primarily supply difficulties. Given the complexity and importance of the ongoing supply difficulties, AVIXA is making it the subject of its next economic deep dive, the second quarter Macroeconomic Trends Analysis (META) report. Hiring is a secondary brake on growth, since labor market tightness has now reached pro AV.”

The pandemic has massively evolved since the start of 2022 and is worth a close look. Since the pandemic became a global phenomenon in early Spring 2020, global daily deaths have been at our above 5,000 for two years straight. That has since changed. Those rates dropped below 5,000 per day in the last week of March and below 4,000 per day in the first week of April.

[Top Integrators 2021: COVID-19 Challenges]

Risks remain—future variants, China’s COVID-zero policy, seasonal factors—but things are now by far the most optimistic since the pandemic began. From the Pro AV perspective, we spotlight the experience economy. So much of Pro AV is in-person-centric: live events, hospitality, entertainment, etc. These sources of revenue, employment, and joy have been greatly affected and reduced for two years. Their recovery has never been closer than it is today.

The labor market—both inside and outside of Pro AV—is extremely strong. Within our industry, the AV Employment Index (AVI-E) marked another month of strong growth. The March reading was 64.9, just as we saw in February. That this AVI-E number is substantially below the AVI-S number of 72.7 should not take away from how strongly positive an indicator it is.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

Employment changes more slowly than sales, resulting in numbers closer to the no-net change level of 50. That context is why 64.9 is actually near-record employment expansion. Such expansion is even more positive when comments make it clear that one reason it’s not higher is because hiring isn’t that easy right now.

U.S. employment numbers help show why. In March, the U.S. economy added 431,000 jobs, extending a streak of 11 months over 400,000 new jobs per month. Labor force participation climbed in March, and unemployment fell. In sum, people are rejoining the labor force, and companies are soaking them up as fast as possible. Supply is growing, but demand is growing more quickly. That makes for a tough hiring market. That said, while it is a challenge, it is also a sign of the positive strength of the current recovery.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.