Preventing the Devaluation of Your AV Services

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

When it comes to AV commoditization, no one is better at devaluing services than AV dealers themselves. Who else would chase a project that represents one-third of their annual business for single digit returns? Who else would price a job based on what the customer is willing to pay instead of what the project is worth? And, who else would respond to the previous statement by saying a job is only worth what the customer is willing to pay? Thank goodness for a strong economy, so we can have a conversation about dynamic pricing.

Most AV integrators operate on the assumption that their capacity is finite—like a hotel or an airline. I will argue another time that this is patently untrue and that outsourcing provides unlimited capacity, but let’s assume for a moment that your company can only handle so much work in a given period. Our lesson today comes from the ultimate fixed inventory business: hotels, who not only set prices based on capacity, but also set value according to demand. Here’s how it works: The hotel knows historically when demand will be high, what various customer segments prefer, and how to stimulate demand based on these facts. As demand increases, lower rate rooms sell out and only more expensive rooms remain, but even when demand is low, hoteliers maintain higher rates on the premium rooms attractive to discerning buyers. The amount of capacity at each price point is dependent on how much overall capacity has been reserved.

The most important pricing factor to the hotel, however, is the value of their brand. Business travelers often book last minute, which is why brands like Marriott can demand higher prices even when occupancy is low amongst competing hotels. Not only do they know that the rooms will fill, they can afford to risk a couple of empty rooms when their average profit per room is above the industry average.

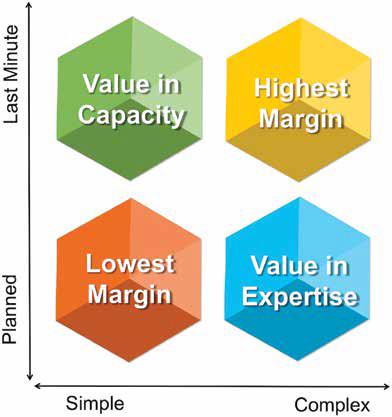

Now, let’s make sense of this for AV integrators. You have capacity for a limited number of highly complex jobs and some number of simpler projects in a given period. The blend of business determines your overall profitability. Therefore, we know that a large, low-margin project will reduce overall returns even though it might boost revenue. Simple or complex is only one axis of the dynamic pricing formula. The other is based on timing. Projects that can be completed on a flexible schedule can be offered at a lower margin. Therefore, “last minute” is worth more than “planned ahead” in supplier terms.

The graphic illustrates that a very complex project on short notice is worth more than one planned and scheduled far in advance. Dynamic pricing for such a project will vary according to the expected demand of the time period. In addition, high-value brands can charge higher fees relative to their competitors. Complexity, timing, demand, and brand levers determine how much value the supplier can negotiate.

Lastly, it is important to point out that dynamic pricing is…well, dynamic. When your forecast and reality don’t jive, change your expectations. A surge in high margin, complex business will reduce capacity for low margin work. And clearly, saving room for last minute business reduces availability elsewhere. Therefore, first, be disciplined about protecting capacity reserved for high-margin work, and second, be accurate about expected demand or risk having unsold capacity.

Most integrators will settle for whatever work presents them at whatever margin they can negotiate. I understand that. Heck, I’ve done that. If you are the leader that wants to break the cycle of stagnant growth and declining returns, then maybe it’s time to put a price on availability, complexity, and demand. But do not neglect the value of your brand. It’s the icing on the cake that will help achieve maximum returns.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

Tom Stimson, MBA, CTS is an expert on project-based selling and a thought leader for innovative business processes. Tom helps owners and management teams rediscover the fun and profit that comes from making better decisions about smarter goals. Since 2006, he has successfully advised over two hundred companies and organizations on business strategy, process, marketing, and sales. Email: tom@trstimson.com

Evolution of Strategic Focus

I changed my career trajectory in late 2006 to become a business consultant— just in time to watch the Great Recession shred my potential client base. My dream of high-level, strategic thinking sessions with industry leaders fell apart as I had to roll up my sleeves and dig through the guts of struggling companies. I likened myself to Major Winchester on the TV show M.A.S.H., being plucked from a cushy base job and thrust into battle surgery. And, like the snooty TV character, I too learned a lot.

For the past six years I have shared many lessons in SCN’s Viewpoint column. I am sure you can uncover all of these articles on AVNetwork.com. In researching for the piece to your left, I discovered a logical progression in my past submissions. Here they are in order:

* 2010 Sales and delivery processes need to function in parallel, not series. Smaller batches of work lead to a faster, more accurate pipeline.

* 2011 Successful companies have a well-developed filter to say “no” to unprofitable work. Retool your company to thrive on good business instead of volume.

* 2012 The marketplace doesn’t want solutions that look hard; they want solutions that work. Stop designing technology systems and start owning the user experience.

* 2013 How is something as complex as an AV system commoditized? Listen to the customer. They only buy on price when there is no other differentiator available.

* 2014 Intentional growth means taking advantage of up markets and making moves that lead to deliberate progress instead of expecting it to happen.

* 2015 If your customer can’t see your value, then the problem is probably in your brand. Understand your customer’s needs and wants before forming a brand promise.

Which leads us to dynamic pricing: Have enough insight into your pipeline, brand value, and demand to maximize seasonal returns.

—T.S.