20 Real Trends in Staging and Why They Matter...And Why Some Don’t

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Daniel Burrus is a futurist that teaches his audiences to differentiate between hard and soft trends. A hard trend is something that will continue to be true, and a soft trend is something that is cyclical. Businesses should respond lightly to soft trends while hard trends need long-term responses. In late November of 2011, I asked about one hundred stagers what they felt would be the significant trends in 2012 that would affect their business. I have filtered out the more irrelevant and politically driven responses and come up with 20 rather astute predictions. Now, let’s figure out what to do with them.

1. Stronger Competition (HARD): Stagers are getting smarter about technology and learning to be more aggressive about business. Perhaps you should invest in training for sales and technology staff?

2. Increase in Lowball Bidders (SOFT): There will always be lowball competition, but the trend is cyclical and the number is limited. You could apply this to lowball buyers as well. The only sustainable solution is to sell high value solutions instead of commodities.

4. Technical Advancements (HARD): I think we all understand that technology continues to get better and do more for less money. So why do we expect to get the same money for five year old projectors? Just saying…

5. Pent-up Demand (SOFT): Never mind the stock market or politically driven news; look at corporate cash reserves. They are huge! What are corporations going to do with this money? Invest in mergers, new products, infrastructure – and all of that means meetings.

6. Demand for Interactive Content (HARD): Stop thinking about digital signage and start paying attention to computer gaming and consumer video usage. A video screen in any size can now be interactive. Who wouldn’t make use of that if they could? Content will always be King.

7. Lack of Confidence in Economic Recovery (SOFT): Too many business leaders are letting their personal uncertainty affect planning. The thing about soft trends is that they move at different paces in different circles. Which circle do you want to be in?

8. Desperate Sales People (HARD): Some folks will always sell out of fear regardless of economic conditions. Difficult times require strong leadership. Don’t let the crew steer the ship.

9. Green/Sustainability Initiative (HARD): Corporations are really focusing on sustainability because they now see cost savings for doing so. It’s no longer hype to the companies that go this direction. Stagers can take advantage of this trend and can also benefit from more sustainable equipment choices.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

10. Increased Marketing Campaigns (SOFT): Companies that are digging out of poor economic situations eventually remember that marketing pays off. This seems to be the case in 2012 – and remember that there is a lot of cash to do this.

11. The Race for Cloud Services (HARD): This is a huge game-changer in terms of how our clients will run their companies and how stagers can better run theirs. Ask someone under 25 years old what this means for you.

12. Hotel Conference Bookings Are Up (SOFT): This is probably the easiest to find economic indicator we have in staging. Major conferences book way far in advance and tie up hotel rooms. When the advance purchase price on hotels is up, so is the AV business.

13. Increased Corporate Outsourcing (SOFT): This trend comes and goes with the economy. When the economy is growing, outsourcing increases. As it levels off, sub-contractors are the first to go. Once employees and internal resources have been cut and the economy starts to move up, outsourcing increases again.

14. Demand for HD (HARD): I don’t think of this as demand so much as an expectation. Stagers will cite that customers are not asking for HD. Duh, do you have any customers that don’t have HD in their living room? HD is an expectation that some stagers are not fulfilling.

15. Over-Saturated Marketing by Competitors (SOFT): Right now I see more Stagers trying to get their message out. Once they get busy, they will forget about it. However, Social Media (not mentioned by any respondents) is a HARD trend and a key part of any marketing plan.

16. Industry Consolidation (SOFT): Mergers and bankruptcies are up in the staging community. This is a good thing for the survivors. Reduced competition means increased prices. Maybe it’s time to increase prices to avoid becoming a casualty?

17. Clients Expect More for the Same Money (HARD): This is not inconsistent with increasing prices. Clients will spend the same money and expect more because they understand about technological advancements. The fact that some stagers are trying to meet this demand with old gear is not the customer’s fault, is it?

18. Procurement Making More Buying Decisions (SOFT): Like outsourcing, this trend comes and goes. When your sales pitch becomes strategic instead of just price and features, you will break this cycle.

19. New Competition with Lower Overhead (HARD): New stagers will continue to have a price advantage because they are investing in more powerful infrastructure and inventory for less money. Eventually some will become burdened by the same lethargy older companies suffer, but new competitors will continue to join the market.

20. The Price of Small Meetings Hardware is Declining (HARD): This affects everyone from venues to stagers. Customers can buy projectors and displays for what some companies want for rental prices. Stagers should focus on the value of their services and solutions and not rental rates.

This is a huge list, but all the more reason Stagers should broaden their economic focus instead of settling on one or two (probably negative) economic trends. 2012 looks to be a great year for AV Stagers.

Market Snapshot Dec 2011

What’s in Store for 2012?

By Tom Stimson

Rental-Stagers frequently underestimate monthly revenue forecasts, which contributes to the feeling of being busy all the time – when results say otherwise. The result of poor forecasting is understaffing, late planning, and expensive fixes – damaging the bottom-line. When it comes to forecasting, experts will tell you that the more facts you have the better your predictions. The trick is determining what indicators really matter and how much. Start with three indicators: Industry, Channel, and Geography.

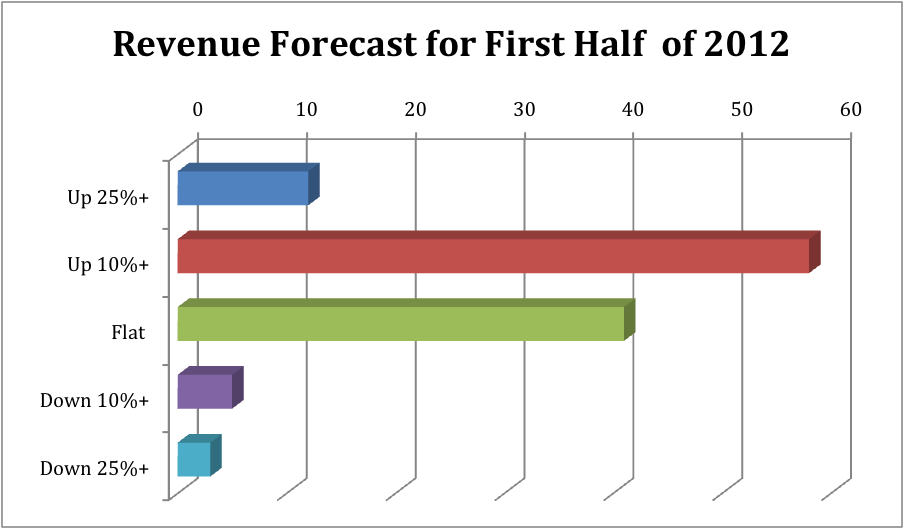

Industry: According to a late-November 2011 survey by The Stimson Group (see chart in Market Snapshot), 67% of the AV Rental & Staging Industry is anticipating at least a 10% increase in revenue for the beginning of 2012. One-fifth of those companies predict more than a 25% increase in business. More importantly, less then 10% of all respondents expect a significant decrease in revenue. This is industry anecdotal data that can contribute to your predictions.

Channel: Your company serves multiple channels that might include corporate meeting planners, creative producers, exhibit managers, conference producers, special event producers, etc… Examine the business you have in your pipeline and notice the channel trends compared to previous years. My prediction for 2012 is that meetings produced by third-party creative teams will be up: the Producer channel. I also expect meetings that are funded by marketing dollars will increase. This means trade shows, sales meetings, and experiential marketing channels. Why? Because in spite of the trouble in financial markets and government budget deadlocks, corporations have a lot of cash and want to drive revenue, which will lead to marketing. Secondly, corporations are running lean, which means they will rely on more outsourcing to produce and manage events.

Geography: Once you have factored industry and channel trends, you have to take into account your geographic positioning. Not all markets are recovering at the same pace. There still seems to be softness in West Coast markets, parts of the industrial Midwest are still moving slowly, but the northeast seems to be booming.

When you use multiple data points, your predictions will improve. When they do, you can improve planning and your profits.