Pro AV’s Consistent Growth Contrasts with Unsteady Global Economy

In contrast to the broader economic news, July wasn’t a tumultuous month for AVIXA’s Pro AV Business Index, with sales growth remaining steady.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In contrast to the broader economic news, July wasn’t a tumultuous month for AVIXA’s Pro-AV Business Index, with sales growth remaining steady. Survey respondents continue to provide a mixed bag on how the summer season affects their business. Some cite that employees’ increased time off hinders project execution, while others in the education space are enjoying a busy time.

“As a consultant, planning is easier in the summertime, with school vacations. On the other hand, executing projects is tough, as technicians and some of the customers are away as well,” shared a design consultant in the Middle East/Africa region.

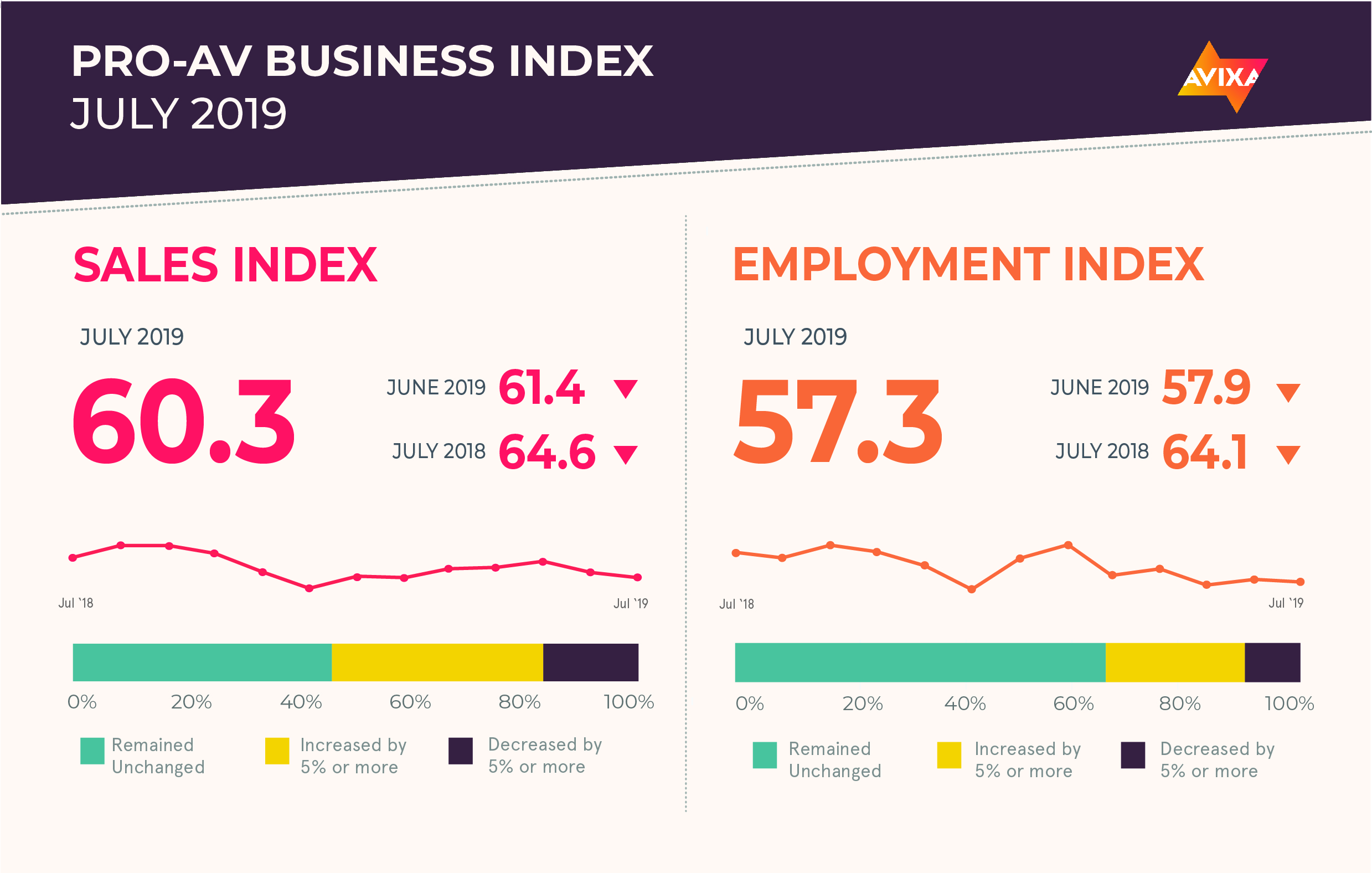

In July, the AV Sales Index (AVI-S) continued to show growth, with a reading of 60.3, or 1.1 points lower than the June mark. An index number above 50 indicates an increase in sales.

“In an illustration of the diverse nature of the pro AV industry, our respondents gave contradictory reports about the impact of summer on their sales,” said Peter Hansen, economic analyst, AVIXA. “The fact that the AVI-S declined—though only barely—suggests that the ‘summer is slow’ folks outnumber those who report that summer is busy.”

The U.S.-China trade war intensified in the first few days of August, which affects the pro AV industry in a multitude of ways. Primarily, it introduces uncertainty and makes businesses less likely to invest and expand. Rising import and export costs also disrupt supply chains and make products more expensive.

The escalation began with President Trump’s introduction of tariffs on another $300 billion of imports — making nearly all Chinese imports subject to some form of trade tax—and worsened with retaliation from China. China’s response centered on allowing its currency to devalue to an 11-year low against the U.S. dollar, which functions like a tariff by making U.S. exports to China more expensive, while simultaneously making Chinese exports to the United States cheaper.

[How AV Pros Can Stay A Step Ahead of Tariffs]

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

U.S. jobs report prognosticators were spot-on in July, as the economy added 164,000 jobs against predictions of 165,000. Wage growth remained tepid at a nominal 3.2 percent change, just 1.6 percent when adjusted for inflation. The pro AV world also reported steady growth in July, with the AV Employment Index (AVI-E) clocking in at 57.3, virtually unchanged from the June mark of 57.9 and the May reading of 56.6.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AV Intelligence Panel, visit avixa.org/AVIP.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.